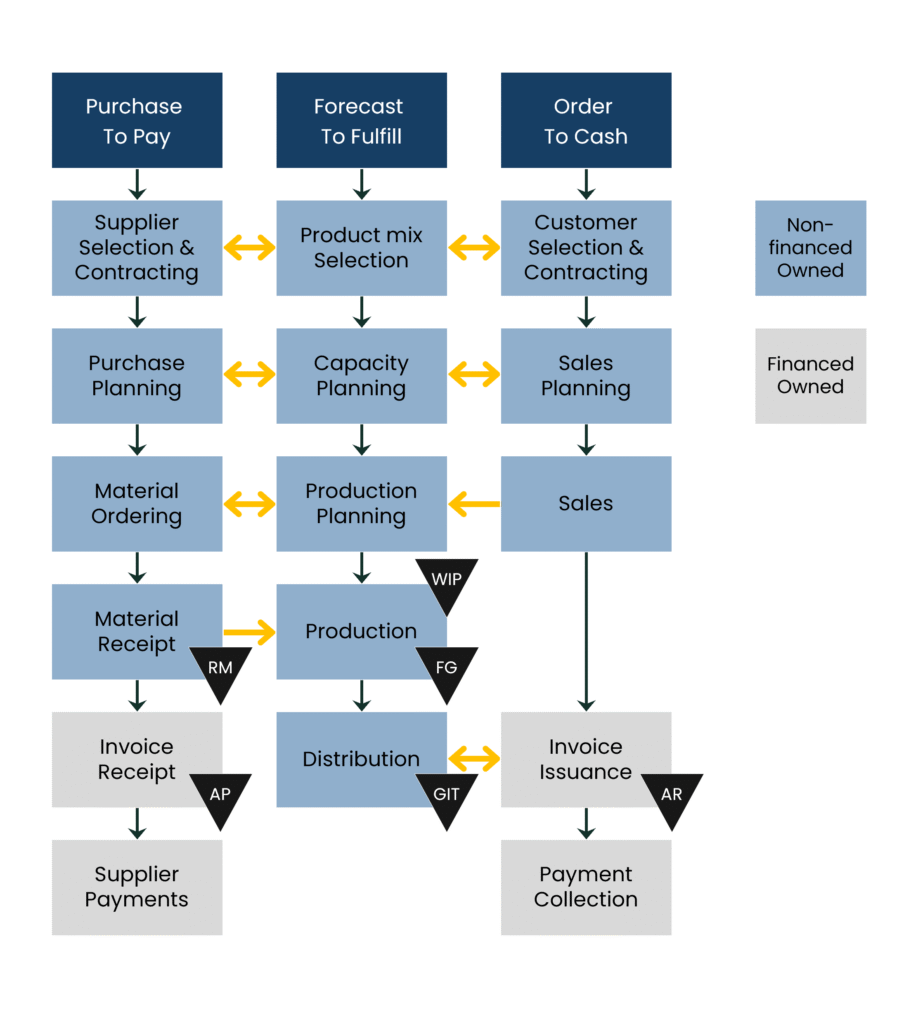

The Cash Conversion Cycle is often approached through one of three separate processes, namely Purchase to Pay, Forecast to Fulfill and Order to Cash.

How well a company manages these processes has a direct impact on its Operating Working Capital requirements and cashflow performance.

Order to Cash (OTC) represents the end-to-end process of receiving and managing customer orders through to collecting payment. It encompasses every step from order entry, credit management, and order fulfillment, to invoicing, payment collection, and dispute resolution.

The OTC process is vital to a company’s liquidity and customer experience, as it determines how efficiently sales are converted into actual cash. Strong OTC performance improves cash flow, reduces Days Sales Outstanding (DSO), and minimizes revenue leakage through billing errors or delays

By optimizing each phase – from accurate order capture to timely invoicing and efficient collections – companies can shorten payment cycles, reduce bad debt, and strengthen customer relationships, ultimately enhancing both working capital performance and profitability.

The Order to Cash (OTC) cycle describes the end-to-end process of converting a customer order into cash in the bank – from order entry and credit checks to delivery, invoicing, payment collection, and dispute resolution.

It is a cross-functional cycle that connects sales, customer service, logistics, billing, credit management, and finance, making it a core driver of liquidity, profitability, and customer satisfaction.

A strong Order to Cash process directly impacts both operating working capital and business performance:

When executed effectively, the Order-to-Cash cycle is not just a financial routine – it is a strategic capability that balances customer satisfaction with robust cash generation.

Unlock the full potential of your Order to Cash process with Working Capital Hubs’ self-assessment framework.

This excel-based tool helps you evaluate each stage of your Order to Cash workflow – from strategy to execution and follow-up – identifying strengths, gaps, and areas for improvement.

Rate your organization’s performance on each sub-category on a 4 graded scale ranging from: Not at all to Complete.

This will help you identify your problem areas, as well as understand where your strengths lie.

Gain control over your sales cycle efficiency and streamline operations with insights designed to enhance your Order to Cash maturity.

Strategy defined and in place, including standardized setup with dedicated resources.

Central credit policy include guidelines for customer selection, segmentation and contract management, e.g., volume, credit assessment, terms, risk, limits and collection processes.

Customer contracts are standardized, including terms and conditions.

Customer contracts are mandatory: usage is tracked and included in sales incentive structure.

Customers cannot e created in master data without contracts.

Sales force KPI’s are defined, communicated and used as base for sales commission.

KPI targets are continuously monitored and updated.

Sales managers’ commission paid on or after date of cash receipt.

Formalized and mandatory process and method for credit risk assessment in place.

Risk and credit assessment made on both new and existing customers.

External credit rating agency used to evaluate customers.

Credit risk policy and workflow in place, including roles and responsibilities for approval of credit limits.

Credit limits are calculated based on credit rating, expected sales and agreed payment terms.

Customers’ credit and financial stress scores are regularly reviewed to realign credit limits and collection approach.

Feedback loop to Sales and Collections of updated credit status is in place.

System automatically places delinquent customers on ‘credit hold’.

Standardized core order-entry and order-management process in place.

Orders are received through EDI or web based order-entry and management system.

All contracts stored and managed electronically by dedicated resources.

Standardized customer contract management practices are in place.

System informs relevant stakeholders of forthcoming contract expirations

Single system to integrate customer service, logistics data and transactions in place.

Order processing include: availability of goods, timing of delivery and communication between logistics and order entities.

Order related issues are actively reported and analyzed to determine root causes.

Standard policy and process in place re: timing of invoice issuance and dispatch approval.

Automatic interface between logistics and billing systems in place to ensure accurate and timely invoices are produced and dispatched to the right customer entity daily.

Invoicing delay monitored and tracked.

Standard invoice design in place.

All relevant information is displayed on the invoice, including due date.

Frequent random checks carried out to check invoice terms vs. contract terms.

Invoice quality monitored and tracked

Customers are invoiced electronically or via EDI.

No paper invoices sent unless specifically required and agreed with customer.

Standard payment terms and conditions defined, including guidelines for application and restrictions for use, and communicated across the organization.

Customer terms and conditions are also aligned with risk profiles and customer segmentation setup.

Use of payment terms monitored and controlled.

Customer negotiation policies in place, including defined processes to manage and reduce negotiation time.

Deviation from standard terms and conditions must always be signed off by senior management.

Sales staff are trained to understand how terms and conditions are to be applied and effect the business (e.g., profitability, working capital etc.)

End of month terms and early payment discounts are generally not standard and requires senior level approval.

Differentiated collection process and approach in place, sensitive to customer characteristics (size, credit risk, historical payment performance, etc.).

Dunning letters automatically sent supplemented by follow up phone calls.

Proactive calling is used for habitual late payers to ensure timely payment

Customers are segmented based on credit risk assessment, share of value, outstanding amounts, and payment history.

Prioritization criteria is used to target top revenue-producing and top aged-A/R-producing customers (habitual late payers)

Process in place for handling habitual late payers, and included in day-to-day collection process.

Pro-active dunning calls performed for sporadic bad payers.

Escalation protocol for habitual offenders is in place and actively used.

Formalized dispute resolution process implemented and enforced – including early dispute identification, dispute coding, escalation process, etc.

Resolution of disputes supported by sales organization to effectively manage customer relationship.

Dispute resolution time monitored and controlled.

Disputes tracked on regular basis and presented split by dispute code.

Formalized process in place to routinely perform root cause analysis and targeted improvement initiatives on identified dispute codes.

Responsibility and approval rights are effectuated and communicated to organization.

All credit note contains link to original invoice ID for efficient tracking and follow-up.

Partially disputed invoices are credited in full where agreed amount is invoiced immediately with no credit time (if original invoice is past due date).

Credit note quantity and amounts are tracked and evaluated periodically.

Corporate payment policy in place and communicated to all customers.

Payment policy restricts payment methods to electronic transfer types.

Process of reconciling ledger with account, including the use of tools and methods to track performance and capture inconsistencies, in place.

Consistent reconciliation process enabled by standard templates.

Centralized monitoring of differences and completeness.

Dashboards and reports provide completeness validations and error tracking.

Formalized cash application process including in place.

Applied payments are classified into appropriate classes (pre-payments, duplicate payments, unallocated etc.) allowing for accurate cash collection forecasting and performance metrics.

Root causes of non-automatic matching reviewed and discussed with customer.

Credit note quantity and amounts are tracked and evaluated periodically.