Want to download this article for free?

Create a free account on My Academy Hub to download the article Benchmarking Working Capital – Why Averages Mislead and Setpoints Matter today.

Benchmarking Working Capital is a widely used – and most often misused – tool in corporate finance. Companies lean on peer comparisons as if they provide clarity on performance, yet in practice they often obscure more than they reveal.

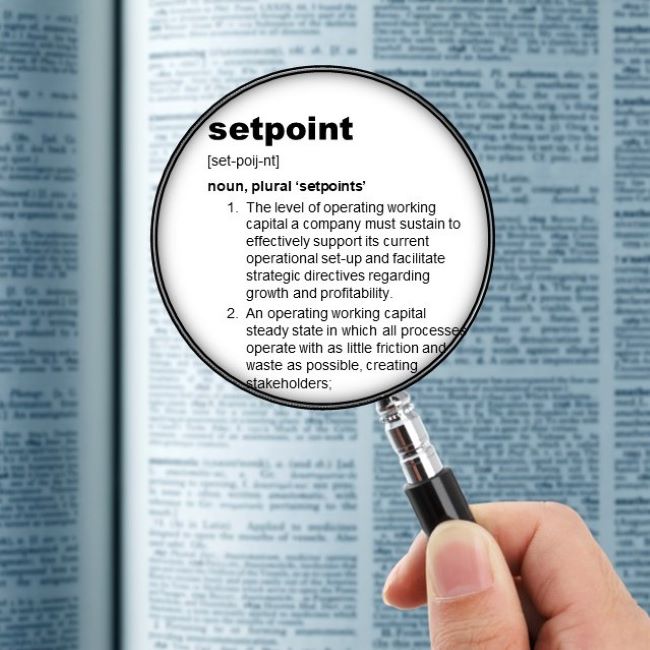

This article challenges the blind reliance on benchmarks, explains why operating working capital (OWC) is too important to be left to averages, and sets out three critical considerations for companies aiming to determine their own optimal working capital position – their Setpoint.

Become a Certified Working Capital Expert with our accredited course Managing Working Capital

Operating Working Capital sits at the heart of a company’s cash conversion cycle – and by extension, its ability to fund growth, withstand shocks, and compete. Yet it is chronically under-managed compared to other capital allocations.

Unlike capex, which is scrutinized at board level, OWC often slips under the radar because its cost is diffuse, and ownership unclear. It hides in balance sheet averages: receivables that take too long to collect, inventories that grow unnoticed, and payables strategies applied inconsistently.

For many companies, OWC represents billions tied up in the system – yet accountability is fragmented and strategy absent. This while every additional day of excess working capital is cash that cannot be invested in innovation, digital transformation, or market expansion.

Treating OWC as an afterthought is not just financially inefficient; it is strategically negligent.

The question is not whether benchmarking working capital is “good” or “bad.” It is whether you understand what it can and cannot do.

Yes – benchmarking can provide useful signals. It can reveal market trends, identify outliers, and spark valuable debates. But benchmarking is not a shortcut to discovering your company’s optimal operating working capital performance – its Setpoint.

Why?

In other words: benchmarking tells you if you’re in the same ballpark – but never where the goalposts are.

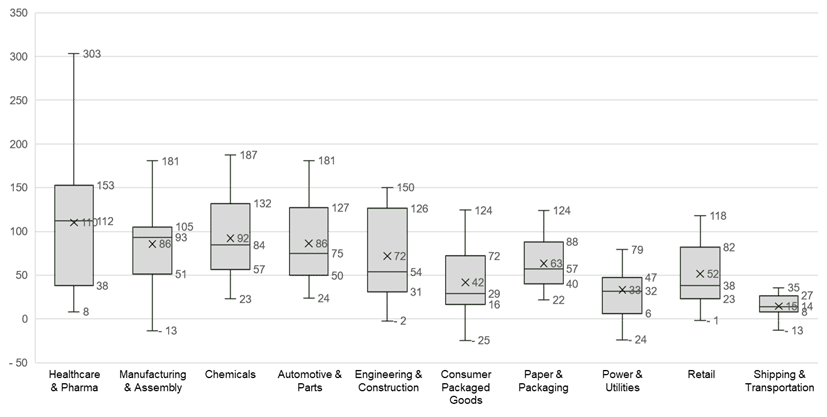

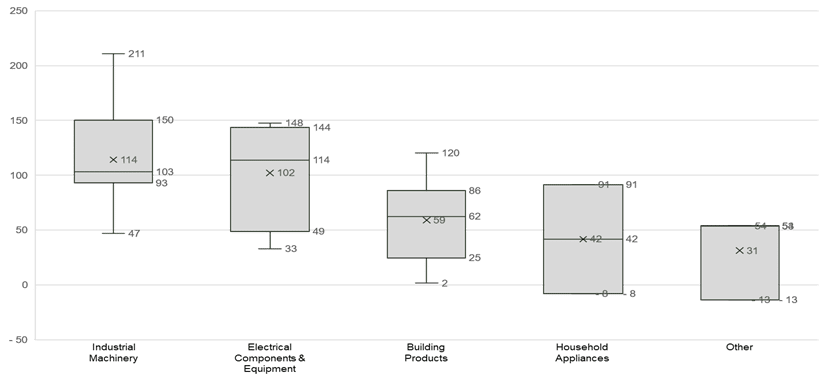

The challenges with benchmarking working capital become clear when we look at cash conversion cycles across industries. Figures 1 and 2 show the distribution of CCC for 160 Nordic companies with annual turnover above SEK 5bn.

What stands out is not just variation – it’s the scale of variation. Even within the same sector, companies differ by months, not days, in how long their cash is tied up in operations.

Source: Sample of 160 Nordic companies with annual turnover >5bn SEK, 2023 reported numbers

What this really tells us

These gaps are far too large to be explained by efficiency alone. They reflect structural realities, such as:

The danger of averages

This is why averages are a dangerous illusion. As statistician Sam Savage quipped: “The statistician drowned while crossing a river that was, on average, three feet deep.”

Setting targets based on industry averages is like wading into that river. It looks safe, but in practice it can pull you under. Companies that chase “median” benchmarks risk:

The result? Performance theatre – ratios that look good on paper, but underlying fragility that leaves the business exposed.

Benchmarking often drives companies into traps that look good on paper but erode performance in reality. Some of the most common mistakes include:

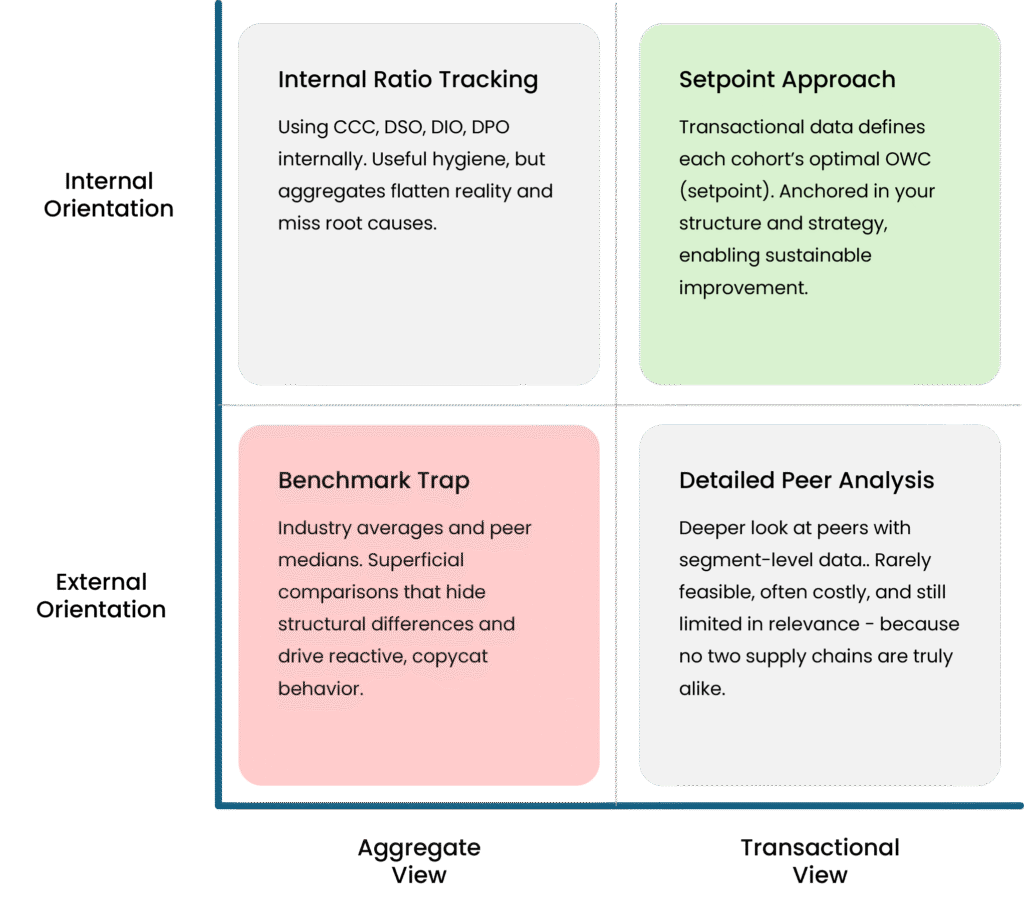

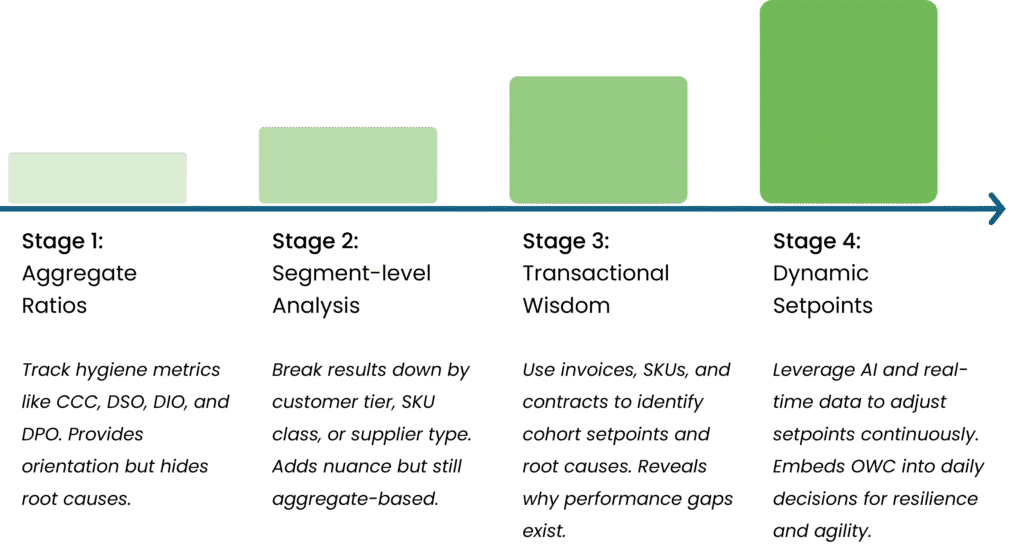

Traditional benchmarking is static. It looks at annual reports, aggregates results, and tells you where you sit against an industry average. Useful at a glance – but limited.

With today’s digitalization and data availability, we no longer need to rely on league tables. Instead, companies can use internal, real-time benchmarks grounded in their own transactions.

What internal Working Capital Benchmarking means:

Internal benchmarking shifts the question. Instead of asking:

“How do we compare to peers?”

ask:

“How does this customer, SKU, or supplier perform against its setpoint — the optimal level, given its terms, planning parameters, and structural context?”

In practice, this means:

This shifts benchmarking from external and generic to internal and actionable.

The Benchmarking Working Capital Trap

External, aggregate-driven benchmarking relies on CCC, DSO, DIO, and DPO ratios that flatten reality into averages. It is:

The Setpoint Approach (via transactional lens)

Transactional wisdom starts with invoices, SKUs, contracts, and suppliers – the real levers of change. It is:

Aggregates tell you what happened. Transactions reveal why.

Benchmarking and ratio analysis are essential – they show whether your company performs above or below peers. But they are descriptive, not diagnostic. Averages compress complexity into a single number, hiding the variance and behavioral patterns that drive your working capital outcomes.

Transactional analysis – line-by-line data from invoices, purchase orders, goods receipts, and payments – exposes these dynamics. It reveals distributions, outliers, and root causes that averages can never show.

For example:

Benchmarks spark hypotheses. Transactions test them.

Aggregates show the outcome; transactions show the mechanism.

By combining benchmarking with transactional analytics – variance, segmentation, and root-cause linkage – working capital management becomes a data-driven control system, not just a reporting metric.

With transactional data, AI, and real-time visibility, external benchmarking may become largely obsolete. The future lies in internal, dynamic setpoints:

External benchmarks will remain useful as context and conversation starters. But internal benchmarks define the answer – by comparing cohorts against their own setpoint and learning from the best performers.

If you still choose to benchmark externally, treat it as hygiene, not a compass. Core metrics such as:

These metrics are useful – but they are the minimum. On their own, they cannot show whether your company is structurally efficient, strategically aligned, or resilient.

For that, you need to go deeper:

There are no shortcuts. Determining your optimal working capital level requires hard analysis, discipline, and cross-functional alignment. Companies that succeed typically embrace three principles:

Working Capital Benchmarking is seductive because it offers easy numbers and comforting comparisons.

But the hard truth is that your optimal OWC setpoint cannot be borrowed from peers. It must be discovered, defined, and defended within the reality of your own supply chain and strategy.

Use benchmarks as mirrors to spark the right questions – but don’t mistake them for answers. The only benchmark that matters is the one you set for yourself.

Turn theory into practice and boost your career with accredited training. Become a Certified Working Capital Expert by enrolling in our flagship course: Managing Working Capital.