In a recent Harvard Business Review article, The Secret to Building a High Performing Team, JP Pawliw describes the “last 8%” problem: people and teams often hold back from the hardest conversations, the riskiest decisions, or the most uncomfortable truths. On average, they stop about 8% short of saying or doing what really needs to be addressed.

This gap may sound small, but its impact is profound. Avoidance at the margins can derail projects, slow decision-making, and create costly blind spots.

Reading Pawliw’s piece, I couldn’t help but see the same dynamic in supply chain and working capital management.

Breaking through Supply Chain Bias is hard!

Find out how in the full article: The Hidden Enemy of Working Capital: How Supply Chain Bias Drains Cash and Agility

Supply chain bias occurs when different functions – sales, procurement, operations, and finance – opt for choices that favor their own performance metrics while avoiding the tougher cross-functional trade-offs.

This could include:

Each decision, in isolation, looks rational. But collectively, they reflect a form of avoidance: teams avoid surfacing the inconvenient truth that these choices undermine the overall cash conversion cycle, impacting both cash flow, and profitability.

In other words, they stop short of the “last 8%”.

Pawliw identifies three cultural traps:

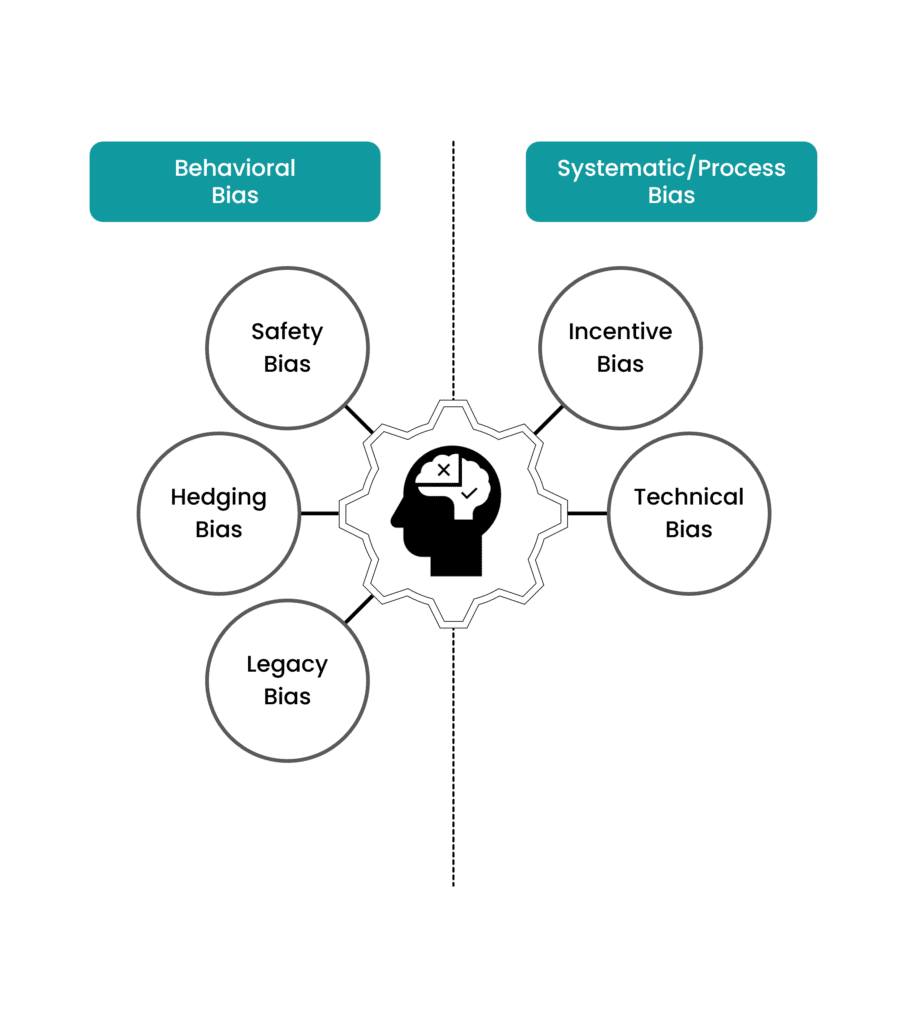

These cultural patterns don’t just shape how teams communicate – they determine whether supply chain bias takes root. Within the Working Capital Hub’s Supply Chain Bias Framework, we identify five recurring biases that inflate working capital when left unchallenged:

Family cultures often allow Safety Bias and Legacy Bias to thrive.

Teams avoid difficult conversations, relying on “just in case” stock or long-standing practices instead of confronting root causes.

Transactional cultures fuel Incentive Bias and Hedging Bias.

Functions pursue their own KPIs – over-forecasting demand, buying in bulk – prioritizing local wins over system performance.

Fear-based cultures leave room for Technical Bias.

Outdated models, parameters, and planning assumptions persist because no one feels safe challenging the system.

These biases are not random – they are predictable cultural responses to avoided truth. Only when organizations build what Pawliw calls a “last 8% culture” – high connection and high courage – can they surface these biases openly, align decisions across functions, and recalibrate working capital toward its true operational Setpoint.

The financial consequences are enormous. Just as in the automotive case Pawliw cites, where silence led to $80–100 million losses, supply chain bias can quietly drain profitability through higher working capital costs, strained supplier relationships, and lost resilience.

Closing the “last 8% gap” in supply chains requires the same leadership ingredients as in teams: psychological safety, accountability, and the courage to name inconvenient truths.

I explore this dynamic in more detail in my article on Supply Chain Bias. If Pawliw’s “last 8%” resonates with you, I think you’ll see the clear parallels in how companies manage (or fail to manage) their supply chains.

Take the course Masterclass – Managing Working Capital at the Hub’s learning center My Academy Hub and gain the skills to turn liquidity into growth and resilience.