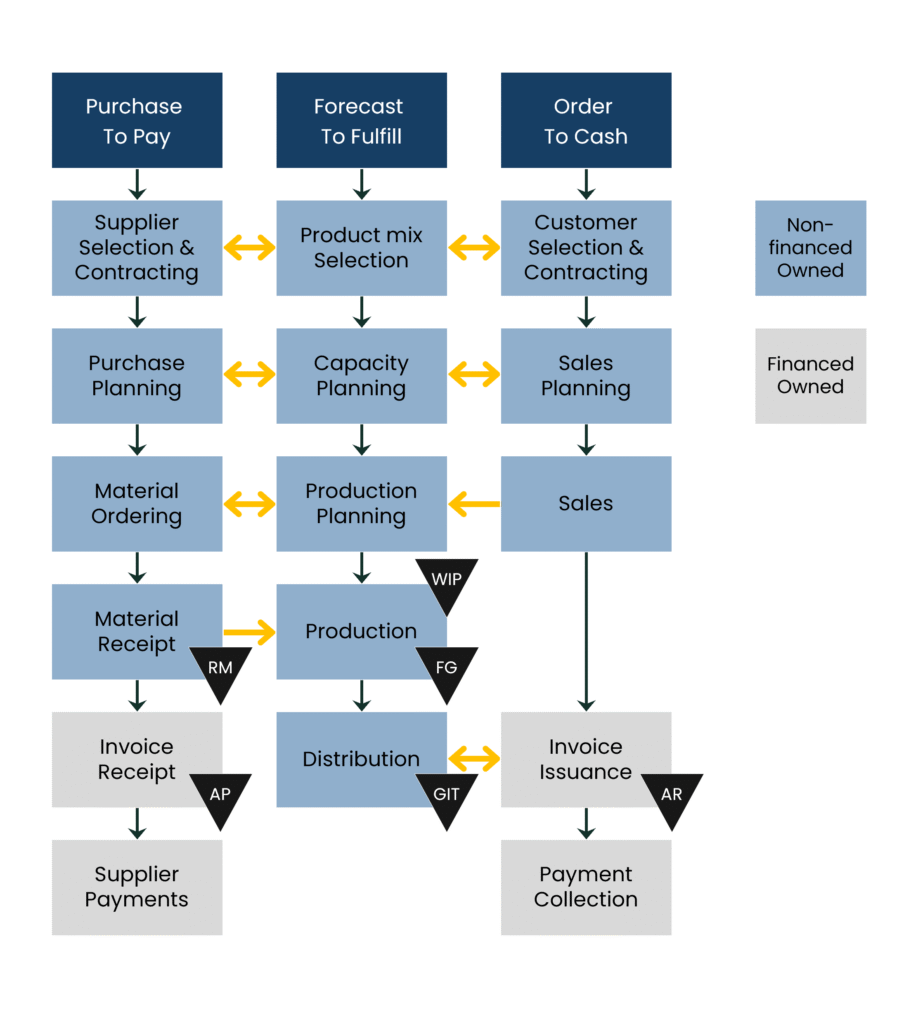

The Cash Conversion Cycle is often approached through one of three separate processes, namely Purchase to Pay, Forecast to Fulfill and Order to Cash.

How well a company manages these processes has a direct impact on its Operating Working Capital requirements.

Purchase to Pay (P2P) covers the procurement lifecycle, from purchasing goods or services to paying suppliers. Key steps include supplier selection, purchase order creation, goods receipt, invoice receipt and matching and payment processing.

The Purchase to Pay process is crucial for working capital management as it directly influences cashflow and liquidity.

By optimizing each step of the cash conversion cycle – from procurement to payment -companies can control expenses, improve supplier relationships, and ensure timely payments, ultimately freeing up cash and enhancing financial flexibility.

Looking to understand the Procure-to-Pay (P2P) cycle in detail? Check out our Complete Guide to Accounts Payable, where we explain how AP fits into the P2P process and share best practices for improving efficiency.

The Purchase to Pay (P2P) cycle covers the end-to-end process of acquiring goods and services and settling supplier obligations – from purchase requisition and order placement, through goods receipt, invoice processing, and final payment.

It integrates procurement, operations, finance, and supplier management, making it a critical driver of both working capital efficiency and supplier relationships.

A well-managed Purchase to Pay process directly influences operating working capital, liquidity, and overall business performance:

When executed effectively, the Purchase-to-Pay cycle is more than a back-office function – it is a strategic enabler of liquidity, supplier trust, and long-term growth.

Unlock the full potential of your Purchase to Pay process with Working Capital Hubs’ self-assessment framework.

This excel-based tool helps you evaluate each stage of your Purchase to Pay workflow – from strategy to execution and follow-up – identifying strengths, gaps, and areas for improvement.

Rate your organization’s performance on each sub-category on a 4 graded scale ranging from: Not at all to Complete.

This will help you identify your problem areas, as well as understand where your strengths lie.

Gain control over your procurement and payment cycle efficiency and streamline operations with insights designed to enhance your Purchase-to-Pay maturity.

Strategy defined and in place, including standardized setup with dedicated resources.

Central sourcing policy include guidelines for supplier selection, e.g., quality, price, standard payment terms, lead time, compliance, and risk.

Formalized material & supplier categorization in place, with dedicated category managers.

Budgets and forecasts by category are regularly updated, monitored and controlled

Approved supplier- and purchase item lists are developed and maintained.

Preferred supplier lists developed and communicated.

Regular spend analysis in place to drive consolidation decisions.

Formalized process and method for supplier evaluation and selection defined, based on sourcing policy guidelines.

Guidelines and decision-criteria for use of frame agreements defined and communicated.

Negotiation guidelines and standard contract templates are accessible to organization.

Method for weighing cost vs. lead time and terms defined and communicated

Authorization levels defined.

Centralized supplier- and contract database in place with restricted system access.

Process to ensure continuous supplier master record update and maintenance in place.

Standardized requisition tools in place and used for the majority of purchases.

Tracking in place to ensure majority of spend is through standard requisition tool and with preferred suppliers.

PO usage policy established.

Control in place to ensure PO adherence to contracts (e.g., price, discounts and terms).

Tracking in place to to ensure POs are used on majority of transactions.

Electronic order system in place and used for a majority of transactions.

Order frequency and volumes are based on demand patterns and replenishment lead-times to ensure optimized inventory levels and availability.

Formalized and mandatory supplier performance measurement system established including key supplier metrics.

Regular and structured performance evaluation in place with feedback loop to supplier.

Standard process in place for receiving, accepting and recording goods or services received.

Tracking in place to ensure process compliance.

System in place to receive invoices electronically or via EDI.

Payment trigger based on invoice receipt in cases where this can be negotiated.

Tracking in place to identify posting delays.

Policies in place for requesting consolidated invoices from large or often used suppliers.

In cases where consolidated invoices are used, they are entered into systems with clear reference to underlying POs.

Automated process for 3-way match installed, comparing at PO, Packing Slip and Invoice.

Tracking in place to identify discrepancies and prevent duplicate entry or faulty invoices.

Process of checking applied invoice payment term versus system terms in place.

Automated overruling of invoiced terms if not matching contract / master data terms.

Standard supplier payment policy in place and always used as base in negotiations.

Supplier payment policy include: specified payment terms, trigger date for payment and guidelines for term application.

Policy in place to minimize the use of supplier prepayments.

In cases where suppliers ask for prepayments (e.g., large volumes or Capex investments), milestone payment plans are negotiated to greater extent.

Policy re: use of early payment discounts in place.

Such discounts are analyzed on the basis of a trade-off analysis against the weighted average capital cost (WACC) .

Senior level approval is required for early payments.

Formalized dispute mgmt. process defined, including roles & responsibilities.

Tracking in place to capture number of disputes, type of disputes and dispute resolution times.

Policy regarding part payments of disputed invoices in place.

For disputes regarding invoice amount, suppliers are required to credit faulty invoices in full and subsequently re-invoice with the correct amount.

Recovery of discounts or duplicate payments are performed according to established dispute management processes.

System setup blocks duplicate payments. Also, PO matching discovers invoice mistakes before payments are released.

Approved invoices due are automatically included in bank run.

Process in place to ensure that no invoices are paid before due date, including periodic follow up.

Invoices due on weekends and holidays are paid the following bank day.

All supplier invoices are processed and paid electronically.

Process determining payment run frequency in place, including differentiated process for domestic versus international payments.

No check payments allowed

Streamlined approach for approval of invoices in place.

Controlled payment authorization process with proposed payment listing review and approval prior to payments.