Working Capital Hub Insights - where knowledge and experience come together

Explore curated working capital hub insights – from quick fact sheets to in-depth best practice manuals.

Leverage our expertise in working capital, cashflow, and the cash conversion cycle so you can focus on innovating, scaling, and building resilience.

Explore the Working Capital Hub Insights Library

Discover practical resources designed to help you master working capital. Filter by category or search to find exactly what you need – from quick references to deep-dive best practice guides.

Looking for accredited training, not just articles?

Check out My Academy Hub for structured courses and certifications.

Working Capital Fact Sheets

Get essential insights on working capital, supply chain finance, and cash flow management.

Each fact sheet delivers quick, practical strategies to help your business strengthen liquidity and improve resilience.

Thought Leadership Articles

Stay ahead with expert analysis and perspectives on working capital management.

Our thought leadership content explores cash flow, liquidity, profitability, and growth – helping you optimize not only working capital, but also overall business performance.

Best Practice Manuals & Guidelines

Access actionable guidance to optimize cash flow, improve profitability, and drive cost efficiencies.

These best practice manuals outline proven methodologies and industry standards, empowering you to make informed decisions that enhance working capital performance and support long-term growth.

Market & Industry Insights

Track key market trends, benchmarks, and developments shaping working capital.

Our market insights help you understand how macroeconomic shifts, supply chain disruptions, and financial innovations impact liquidity and the cash conversion cycle.

elearning Course Overviews

Build practical skills through accredited courses designed to strengthen working capital management.

Our programs combine theory with real-world applications, giving you tools to improve liquidity, optimize the cash conversion cycle, and drive measurable business impact.

The Hub Point of

Views

Explore expert perspectives on the evolving role of working capital in business performance.

Our point of view articles challenge assumptions, highlight emerging practices, and provide actionable insights to help you shape strategy and decision-making.

Working Capital Hub Insights Library – All Resources in One Place

Browse the full library of Working Capital Hub Core Insights. Filter by category or search to quickly find fact sheets, thought leadership, best practice manuals, and market insights that match your needs.

- Thought Leadership

AI-Powered Credit Analysis: How Automation and Software Are Transforming B2B Lending

- Thought Leadership

The Hidden Enemy of Working Capital: How Supply Chain Bias Drains Cash and Agility

- Best Practice Manuals, Fact Sheet

Accounts Receivable: Complete Guide, Metrics & Best Practices

- Best Practice Manuals, Fact Sheet

Accounts Payable: Complete Guide, Metrics & Best Practices

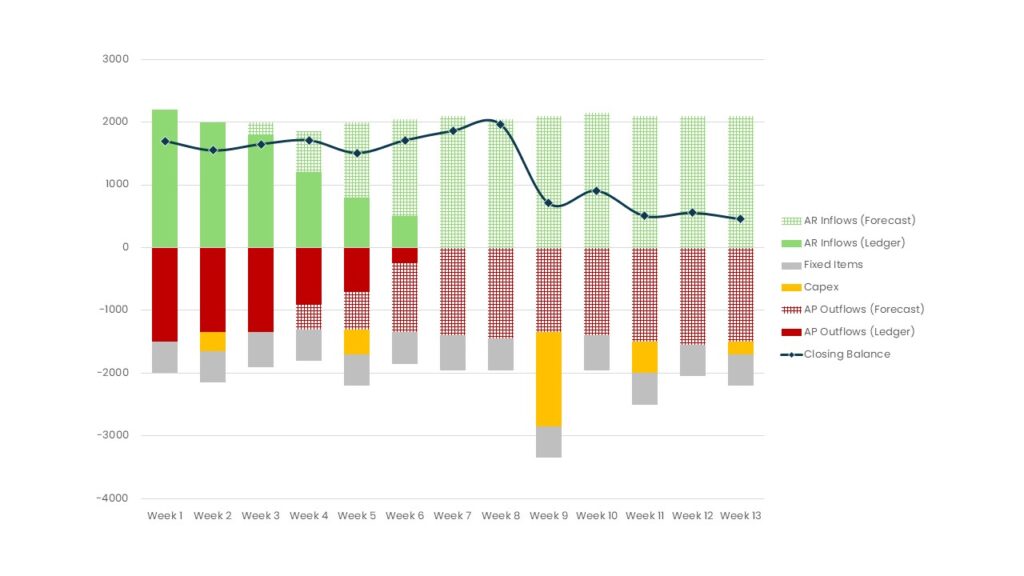

- Best Practice Manuals

Short-Term Cash Flow Forecast (STCF): Definition, 13-Week Model, and Best Practices

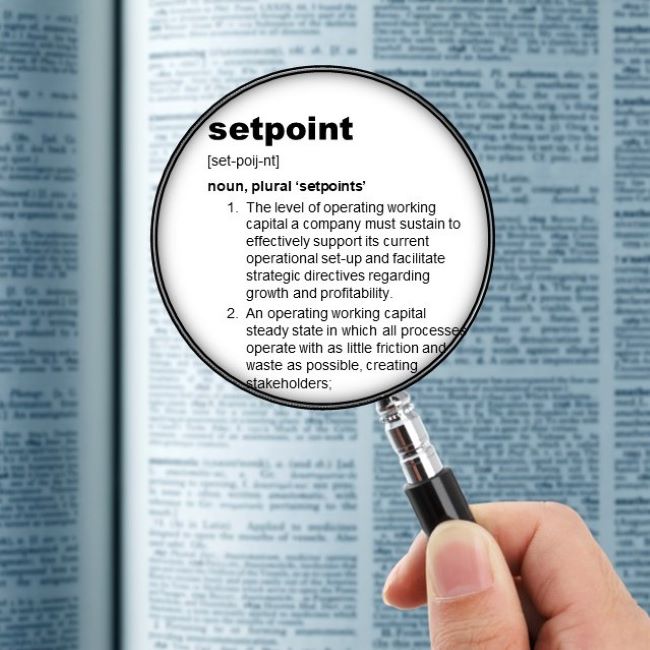

- Thought Leadership

The Operating Working Capital Setpoint: Finding the Sweet Spot Between Cash, Growth, and Resilience

Categories

Download articles, documents and tools – simply create an account in My Academy Hub to access the full library for free.

Latest Perspectives – Quick Takes from the Hub

Explore concise viewpoints on working capital, cashflow, and the cash conversion cycle. These short-form perspectives highlight timely trends and practical observations – designed to complement our in-depth Insight Library with fast, actionable takeaways.

- The Hub Point of View

If Working Capital Won’t Improve, You’re Battling Bias – Not Constraints

- The Hub Point of View

The “Last 8%” of Supply Chains: Where Bias and Avoidance Undermine Performance

- The Hub Point of View

5 Working Capital Misconceptions That Could Be Costing You Growth

- The Hub Point of View

13-Week Cash Flow Forecast Pitfalls (and How to Avoid Them)

- The Hub Point of View

Common Mistakes in Benchmarking Working Capital – and What to Do Instead

From insight to impact

Turn ideas into skills. Explore our accredited working capital courses and apply insights directly in your role.

Frequently Asked Questions on Working Capital Management

From cashflow and the cash conversion cycle to profitability and resilience, these Working Capital Hub Insights FAQs explain why strong working capital practices matter for long-term business success.

What is working capital management and why is it important?

Working capital management is the process of balancing current assets and liabilities to keep operations running smoothly. Its role goes far beyond liquidity: strong practices safeguard profitable growth by freeing up capital for investment, improving return on capital employed (ROCE), and strengthening financial resilience.

By aligning cash flow with business cycles, reducing reliance on external financing, and improving margins through lower interest costs, effective working capital management becomes both a profitability driver and a foundation for long-term growth. It also shapes daily operations, ensuring suppliers are paid on time, customers are billed and collected promptly, and every process contributes positively to cash and performance.

How does the cash conversion cycle impact liquidity?

The cash conversion cycle (CCC) measures how quickly investments in inventory and receivables turn back into cash. More than a liquidity indicator, CCC is a barometer of competitiveness: a faster cycle means more cash available for growth and innovation without sacrificing profitability.

By reducing financing costs and improving cash predictability, companies strengthen both margins and resilience. At the same time, improvements in areas like inventory turnover, billing accuracy, and supplier terms directly shorten the cycle, enhance profitability, and safeguard sustainable growth.

What are common strategies to improve working capital?

Working capital optimization is about finding the right balance between liquidity and profitability. Companies that succeed build stronger balance sheets, freeing up capital to invest in innovation, expansion, and acquisitions. They also apply proven tools such as supply chain finance, dynamic discounting, and more accurate cash forecasting to reduce cost of capital and improve margins.

On an operational level, everyday practices - from better demand planning and timely invoicing to closer supplier collaboration - all play a part in strengthening liquidity, enhancing profitability, and creating the conditions for long-term growth.

Where can I find best practices and insights on working capital?

You can explore them in our Hub Insights library, which brings together fact sheets, thought leadership articles, best practice manuals, and market insights. These resources show how effective working capital management drives long-term value creation, strengthens margins, and improves resilience, while also providing practical frameworks and benchmarks to guide decision-making.

Alongside strategic perspectives, you’ll also find hands-on methods that finance, procurement, and operations teams can apply in their daily work to optimize cash flow, profitability, and growth.

Does the Working Capital Hub provide training or certification?

Yes. Beyond fact sheets, best practice manuals, and market insights, the Hub also offers accredited online courses in working capital management through its dynamic learning center My Academy Hub.

These programs combine practical frameworks with industry-recognized standards, giving professionals the skills to optimize cash flow, improve profitability, and safeguard long-term growth. The accreditation provides formal recognition of expertise, helping both individuals and organizations build stronger capabilities in managing working capital effectively.

Help Us Improve Working Capital Hub Insights!

Can’t find what you’re looking for in Working Capital Hub Insights? Let us know – We continuously update our resources to keep them relevant and impactful.

Or, do you – or someone in your network – want to contribute to the Hub? We welcome expert perspectives, case studies, and thought leadership that can help strengthen our growing community.

Become a Certified Working Capital Specialist

Work smarter with Working Capital Hub Insights – your source of curated insights and practical tools to strengthen cash flow and business performance.

Take your expertise further with MyAcademyHub.com, home to CPD-accredited online training courses designed by practitioners with real-world experience.

Accreditation ensures your learning is structured, high-quality, and professionally recognized – giving you the credibility, career advantage, and confidence to apply working capital strategies that deliver measurable results.