Globally, trillions are trapped in working capital. The S&P 1500 alone has seen its cash conversion cycle stretch by 2.4 days – locking up $707 billion in liquidity, a 40% rise since before the pandemic. Across Europe, PwC estimates €1.56 trillion is stuck on balance sheets.

These numbers aren’t just accounting trivia – they are missed opportunities. Companies that treat working capital as “housekeeping” are leaving growth, resilience, and competitiveness on the table.

The bigger problem? Too many leaders still fall into the trap of outdated assumptions. These misconceptions don’t just cloud decision-making – they weaken supply chains and make companies fragile when shocks hit.

Here are the five biggest myths and working capital misconceptions – and why breaking them is the key to finding your true Operating Working Capital (OWC) Setpoint.

Busting working capital misconceptions is easy.

Finding your Operating Working Capital Setpoint is what drives real advantage.

Many executives still treat working capital as a trade-off: you either hold more liquidity to stay safe, or you sacrifice cash for growth and margin. But this is a false choice.

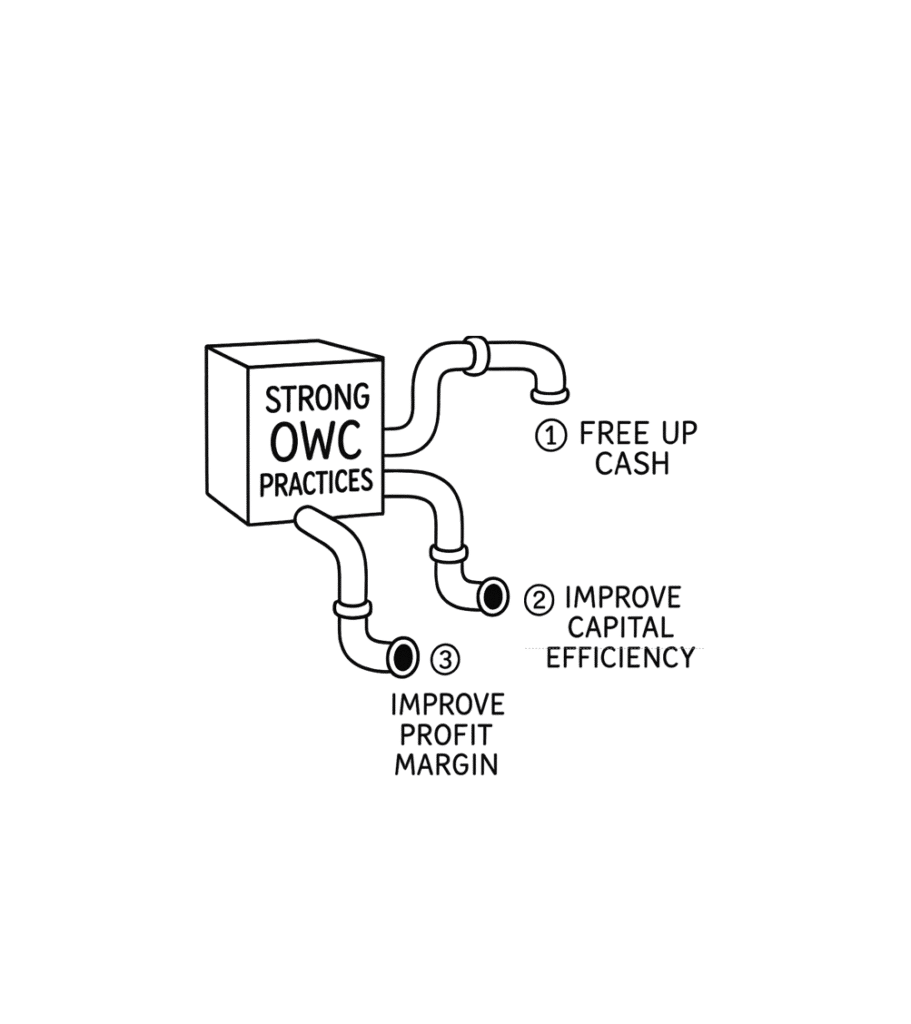

The reality: lean, well-managed Operating Working Capital (OWC) fuels profitability on two fronts:

Think of it this way: every euro tied up in excess inventory, slow receivables, or early supplier payments is a euro not earning a return. And every inefficient buffer hides waste in the system that silently erodes margin.

A European industrial supplier carried 120 days of inventory “for safety.” On paper, this looked like a cost of doing business. But analysis showed that 30% of that stock was slow-moving or obsolete. By recalibrating to its true Setpoint, the company released €85 million in working capital and saved €6 million annually in financing costs. At the same time, better forecasting and supplier coordination reduced urgent last-minute shipments – cutting logistics costs by 12% and directly improving gross margin.

Profitability and working capital aren’t competitors. They are partners. Lean OWC ensures capital works harder and operations run leaner – expanding margins and funding growth at the same time.

It’s tempting to think that the leanest possible balance sheet is the best one. But in working capital, “less” can quickly become “too little.” Cutting buffers below what operations really need doesn’t create efficiency – it creates fragility.

The result? Stockouts, broken production schedules, and costly last-minute firefighting. These disruptions don’t just erode service levels – they also create waste in the form of overnight freight, idle labor, and missed sales opportunities. What looks like savings on paper often shows up as hidden cost in operations.

Lean OWC is not about starving the system. It’s about finding the Setpoint – the level where working capital is lean enough to release cash, but not so tight that it triggers constant friction. The right buffers absorb variability without masking inefficiencies.

A consumer electronics company pushed “just in time” inventory to extremes. For several months, working capital metrics looked fantastic. Then a two-week delay from a critical component supplier shut down production of a top-selling product.

The scramble for expedited shipments and the lost quarter of sales wiped out years of incremental OWC gains. By recalibrating to its Setpoint – carrying just enough buffer to absorb predictable volatility – the company protected cash and preserved customer trust.

Efficiency is not the same as minimalism. The OWC Setpoint helps companies run leaner without slipping into constant firefighting – reducing friction, protecting resilience, and ensuring that every euro of working capital is truly productive.

Many companies only focus on working capital when the pressure is on – when debt repayments loom, liquidity dries up, or a crisis hits. This reactive approach usually means pulling the blunt levers: slashing inventory, chasing receivables harder, or squeezing suppliers. While these measures might free up short-term cash, they often create new problems—damaged relationships, broken supply chains, or future costs hidden just out of sight.

The numbers bear this out. In 2024, the S&P 1500’s cash conversion cycle lengthened by 2.4 days, driven by rising receivables and inventory. That may sound small, but across thousands of companies it represents $707 billion in liquidity that could have been fueling growth instead of sitting idle. Reactive working capital practices don’t just fail to capture this value – they often make the problem worse when shocks hit.

Proactive OWC discipline is very different. By embedding good practices into data, processes, and culture, companies reduce friction and firefighting before it starts. Demand planning becomes more accurate, receivables are managed with consistency, and supplier terms are balanced with resilience in mind. Instead of scrambling to patch liquidity gaps, the organization runs smoothly – even when external shocks hit.

During the 2020 global supply chain disruptions, many companies reacted by cutting orders or extending payables aggressively. This triggered stockouts, strained supplier relationships, and in some cases, drove up costs as suppliers demanded risk premiums.

By contrast, a leading consumer goods company that had already embedded proactive OWC discipline – real-time visibility into receivables, supplier collaboration agreements, and AI-driven demand planning – was able to absorb the shock. While peers faced weeks of disruption, this company kept shelves stocked and preserved customer trust, all while keeping liquidity steady.

Working capital managed reactively is always a crisis waiting to happen. Lean OWC managed proactively reduces firefighting, strengthens resilience, and ensures the business can absorb shocks without losing momentum.

Notice a pattern? Myths and working capital misconceptions hides not just cash, but friction- waste, firefighting, and sub-optimal processes. The danger isn’t only trapped liquidity on the balance sheet, it’s the hidden operational drag that slows companies down when shocks hit.

Lean OWC doesn’t just release liquidity – it reduces waste, cuts firefighting, and builds resilience into the system. That’s why the Setpoint matters: it’s not about cutting harder, it’s about running smoother.

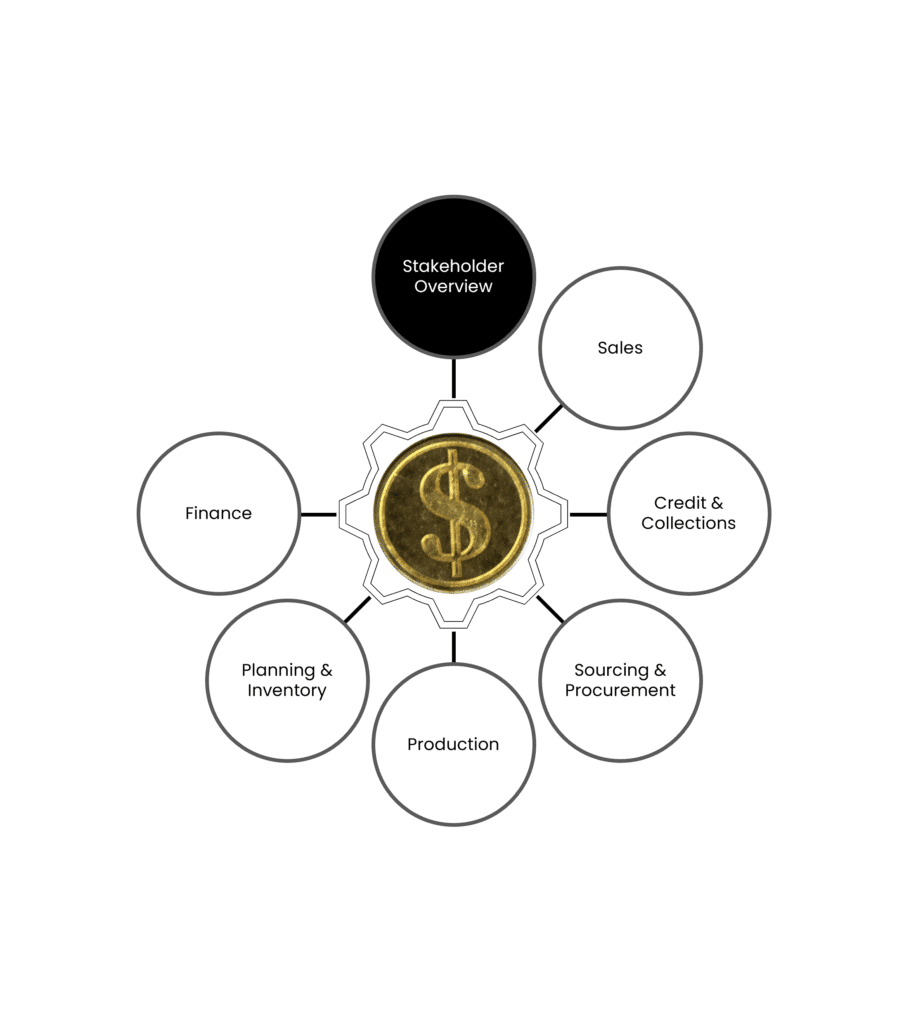

Working capital often gets pigeonholed as a finance metric – monitored in reports, discussed at quarter-end, and treated as something for CFOs to worry about. But here’s the reality: while finance measures OWC, it is operations and supply chain that shape it every day.

Procurement negotiates supplier terms. Sales decides on customer credit. Planning teams set inventory levels. If these functions don’t work in sync, no amount of financial reporting will deliver improvement.

True working capital performance comes from cross-functional alignment – finance providing visibility and discipline, operations executing processes consistently, and procurement balancing supplier resilience with liquidity goals.

A global retailer’s finance team pushed for a 15% inventory reduction to release cash. On paper, this looked achievable. But planners knew that demand spiked every holiday season and that cutting too deep would leave shelves empty.

With no joint ownership of OWC, the company slashed inventory anyway – only to face widespread stockouts in December, losing millions in sales and damaging customer trust.

Contrast that with a competitor in the same sector that treated OWC as a shared responsibility: finance flagged excess stock, planners refined forecasts, and procurement negotiated flexible replenishment with suppliers. The result was a leaner balance sheet and full shelves at peak season.

Working capital is not finance’s problem – it’s everyone’s problem. Companies that break silos and embed OWC as a shared discipline reduce waste, avoid firefighting, and turn liquidity into a true competitive advantage.

It’s tempting to “fix” working capital by focusing on just one lever – stretching payables, squeezing receivables, or cutting inventory. But this siloed approach rarely delivers lasting results. Working capital is a system, and like any system, optimizing one part in isolation often undermines the whole.

Pulling on one lever without adjusting the others creates friction and unintended consequences. Extending supplier terms may free up cash temporarily but risks delayed deliveries, higher costs, or supplier pushback. Cutting inventory may make the balance sheet leaner but can lead to stockouts, rush orders, and lost sales. Even tightening receivables aggressively can backfire – damaging customer relationships or slowing growth.

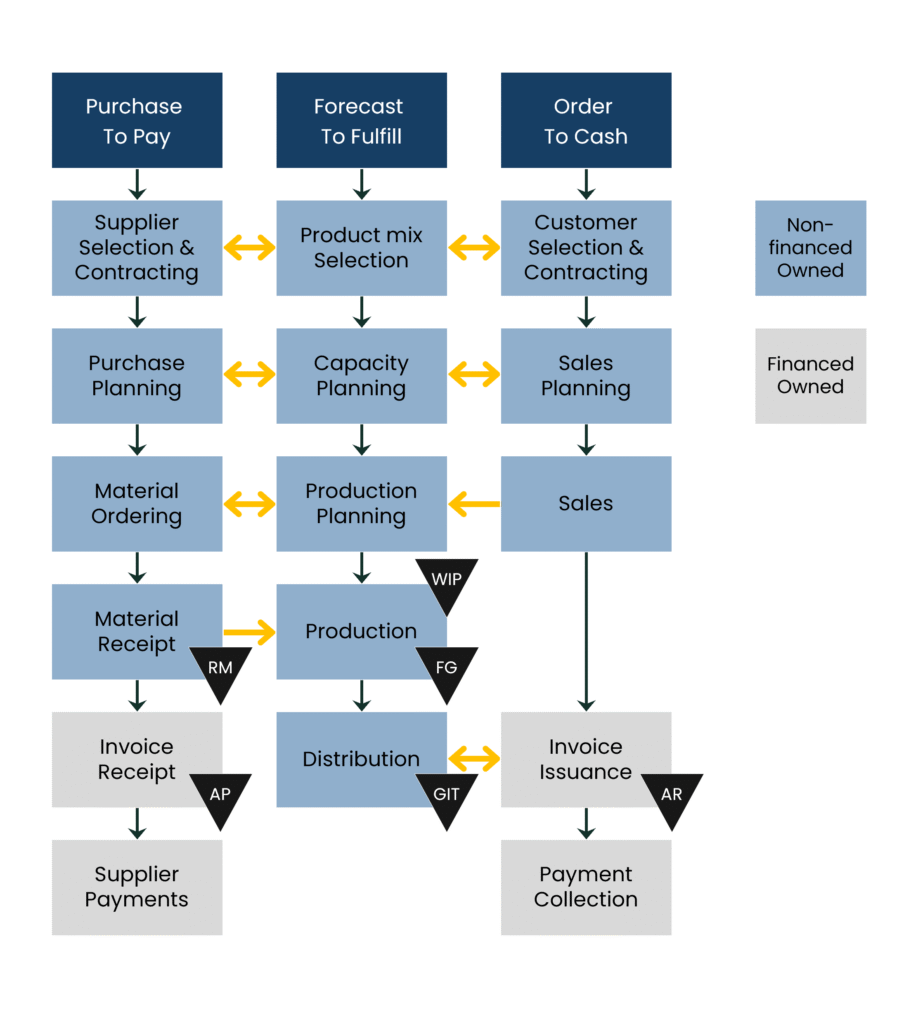

A big reason for this problem is how core processes are often managed separately:

Each process has its own KPIs, owners, and improvement projects. But in reality, they are tightly interconnected: a change in payment terms (P2P) affects supplier reliability, which affects inventory buffers (F2F), which then influences delivery performance and receivables (O2C). Local optimization – improving one process in isolation – often leads to sub-optimization of the system as a whole.

The real gains come when inventory, receivables, and payables are calibrated together across these processes, aligned with the company’s operating model and supply chain conditions. This is what the OWC Setpoint defines: the equilibrium where all three levers support each other, freeing cash without creating hidden costs.

A manufacturing company decided to extend supplier payment terms from 45 to 90 days, aiming to free up liquidity. At the same time, receivables were unmanaged and inventory levels ballooned due to poor forecasting.

The result? Cash flow barely improved, suppliers built in risk premiums, and carrying costs rose as warehouses filled with the wrong products. By contrast, when the company later adopted a Setpoint approach – connecting P2P, F2F, and O2C into one system view – it released cash and improved supply chain performance.

isolated fixes and siloed processes are short-term illusions. True working capital improvement happens when purchase-to-pay, forecast-to-fulfill, and order-to-cash are managed as an interconnected system – balanced at the Setpoint where liquidity, resilience, and efficiency reinforce each other.

Working capital often gets pigeonholed as a finance metric – monitored in reports, discussed at quarter-end, and treated as something for CFOs to worry about. But here’s the reality: while finance measures OWC, it is operations and supply chain that shape it every day.

Procurement negotiates supplier terms. Sales decides on customer credit. Planning teams set inventory levels. If these functions don’t work in sync, no amount of financial reporting will deliver improvement.

True working capital performance comes from cross-functional alignment – finance providing visibility and discipline, operations executing processes consistently, and procurement balancing supplier resilience with liquidity goals.

The common thread across these five working capital misconceptions? They all point to the need for Lean Operating Working Capital and a clear understanding of a company’s optimal working capital requirements – their Setpoint. This is the calibrated balance where cash, growth, and resilience reinforce each other.

To see how the Setpoint works, how to calculate it, and why it’s a game-changer, read: The OWC Setpoint: Finding the Sweet Spot Between Cash, Growth, and Resilience.”

Take the course Masterclass – Managing Working Capital at the Hub’s learning center My Academy Hub and gain the skills to turn liquidity into growth and resilience.