Want to download this article for free?

Create a free account on My Academy Hub to download the article Short-Term Cash Flow Forecast (STCF): Definition, 13-Week Model, and Best Practices today.

Cash is the oxygen of business. A company may report healthy profits but still face financial stress if it cannot generate enough cashflow to meet short-term obligations such as salaries, supplier payments, loan instalments, or critical investments.

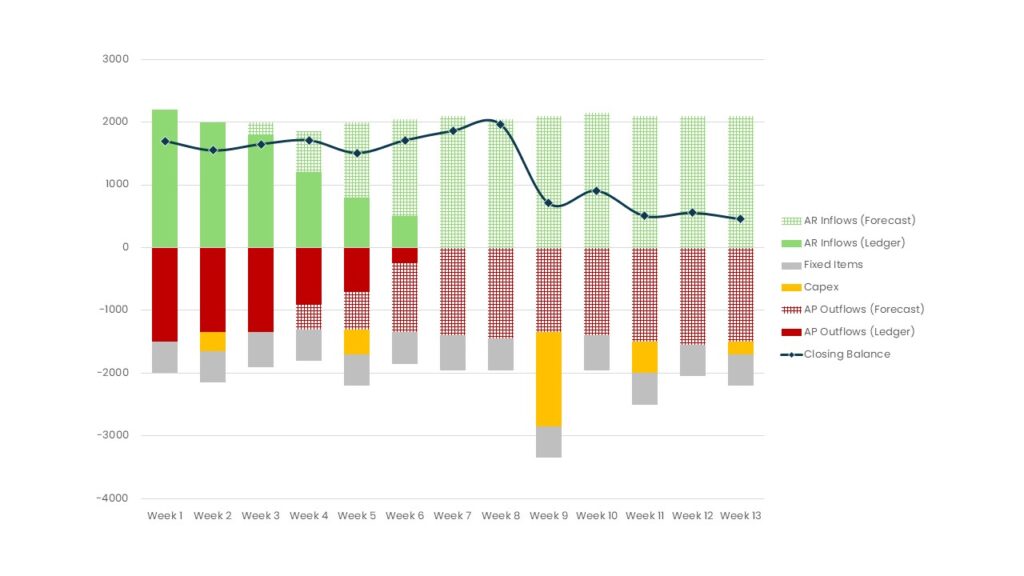

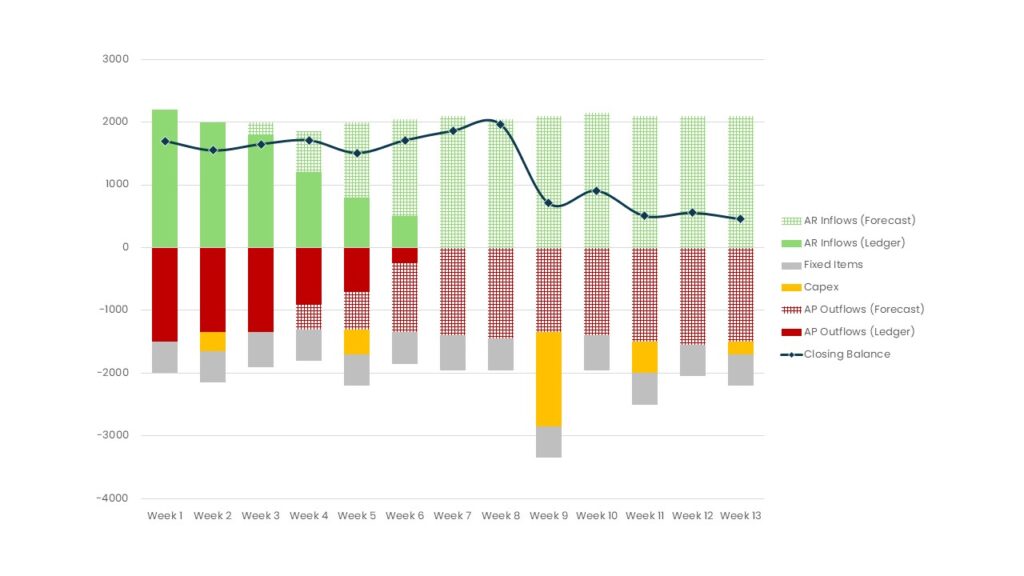

This is where the Short-term Cash Flow Forecast (STCF) comes in. Unlike a traditional cash flow statement, which reports past performance, the STCF looks ahead. By focusing on the next 6–13 weeks, it connects directly to a company’s operating working capital (OWC) – the receivables, payables, and inventory that drive daily liquidity.

Because OWC is the foundation of the cash conversion cycle (CCC), the STCF offers more than just visibility into balances. It shows how quickly a company can turn working capital into cash, and whether liquidity is being released efficiently or tied up unnecessarily in operations.

When applied consistently, the STCF does more than flag cash crunches. It strengthens business decisions, builds transparency with banks and investors, and fosters a stronger cash culture by engaging functions outside finance in planning.

Become a Certified Working Capital Expert with our accredited course Managing Working Capital

We operate in an era of volatility – economic cycles, supply chain shocks, and geopolitical disruptions are all part of business reality.

In this environment, sales and profitability are not enough. Companies need to know how quickly profit converts into cash.

A robust STCF helps organizations:

Key insight: Profit may be reported quarterly, but cash is lived daily. The STCF turns liquidity into a managed outcome instead of a surprise.

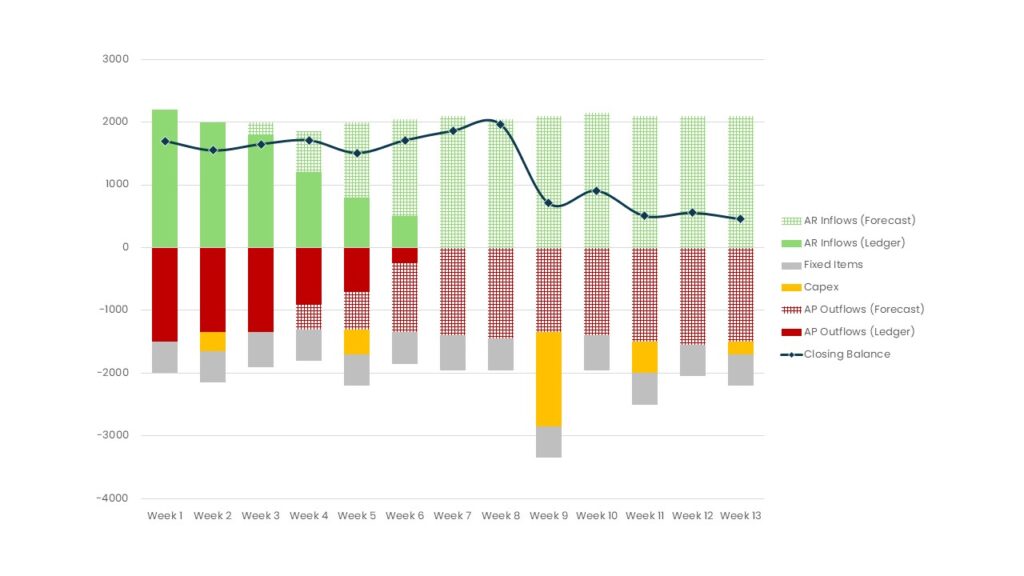

Most short-term cash flow forecasts are built on a 13-week rolling horizon. This choice isn’t arbitrary – it balances accuracy, visibility, and decision-making in a way few other horizons can match.

Example: If your Week 10 forecast shows a potential shortfall at quarter-end, management still has time to accelerate invoicing, defer capex, or draw on facilities. Without the 13-week view, the issue may only appear when it’s too late to act.

Bottom line: The 13-week forecast is widely regarded as the optimal baseline because it provides just enough foresight to act decisively without sacrificing reliability. It is the practical sweet spot between precision and planning range.

A common debate in short-term cash forecasting is whether to build the model bottom-up (from transactional detail) or top-down (from aggregate trends and assumptions). Both approaches have strengths and weaknesses:

Bottom-up (transaction-driven)

Top-down (assumption-driven)

So, which is better?

In practice, the most effective STCF’s combine both approaches:

One of the key design choices in setting up a short-term cash flow forecast (STCF) is deciding where assumptions are created: should it be a centralized group exercise, or should accountability be pushed down to business units and local entities?

Centralized group-led forecasting

Local accountability with group aggregation

Striking the right balance

In practice, most companies benefit from a hybrid model:

Key takeaway: Push ownership down to the business where the cash actually moves but maintain central governance to ensure discipline and comparability. The forecast must be both trusted locally and usable at group level.

Building an STCF doesn’t require a sophisticated treasury system. In fact, the most effective starting point is usually a simple spreadsheet that everyone can access and understand.

What matters most in the beginning is discipline, consistency, and collaboration. Think of the forecast as a living tool – its accuracy and usefulness will improve week by week as assumptions are tested against reality.

As the process matures, system support becomes valuable. Dedicated cash forecasting platforms can:

But systems alone won’t deliver value without the right process and ownership in place. Discipline first, tools second. With that principle in mind, here’s how to set up your first forecast in practice.

How to set up your first STCF in practice.

Begin by structuring your forecast over a 13-week rolling horizon. Create weekly columns (W+1 … W+13) and divide the rows into three blocks:

This simple setup ensures that anyone – even colleagues outside finance – can follow how money is expected to flow through the business.

Every forecast starts with today’s cash. Import the opening balance directly from your bank reconciliation. This figure is your anchor point: if it’s wrong, the entire forecast is distorted.

Practical tip: Always reconcile to bank statements, not just accounting ledgers. Even small timing differences in the starting balance can snowball over 13 weeks.

Next, bring in your accounts receivable (AR) and accounts payable (AP) ledgers. But don’t just copy due dates straight into the forecast – model by expected cash date, which reflects how payments actually happen.

Finding the right level of detail

Trying to model every single customer and supplier individually is impractical. Instead, use a tiered approach:

Refine over time: Use actual vs. forecast reviews to promote consistently “off-track” accounts into the individually tracked group.

Key point: Focus on the big drivers and realistic averages. Don’t get lost modelling the long tail.

Now layer in recurring outflows that are predictable to the day. These bring stability and credibility to your forecast:

Because these flows rarely change, they provide a reliable backbone for the forecast.

Capex is often overlooked in early forecasts – but it can create sudden, significant cash dips. Always include:

Don’t spread the Capex budget evenly across weeks. Instead, challenge business units to provide their best estimate of timing and amount.

Ownership and accuracy here are critical, since Capex outflows are often discretionary but large enough to impact liquidity materially.

At this stage, supplement the known ledger items with forecasted future flows. This requires close collaboration with sales, procurement, and operations.

Tip: Avoid double-counting – when combining forward-looking estimates with ledger items, make sure the same invoice or order isn’t included twice. A good practice is to start with ledger data, then add only incremental forecasted flows beyond what the ledger already shows.

A forecast is only as valuable as the discipline around it. Once you’ve built the first version, freeze it weekly and share it in a structured review forum. This turns the STCF into a management tool rather than a spreadsheet exercise.

How governance works in practice:

Key point: The purpose of the STCF is not perfection. Forecasts will never be 100% accurate. The real value lies in the conversations, accountability, and early decisions the process enables. Accuracy improves naturally over time through feedback loops.

Example: If payroll, VAT, and a major supplier invoice overlap in the same week, the STCF will flag a cash dip. The cross-functional forum can then decide whether to adjust payment timing, accelerate collections, or tap a facility – well before the issue hits the bank account.

Bottom line:

A strong STCF is built step by step: start simple with actuals and ledgers, layer in fixed and discretionary items like Capex, and finally add forecasted flows from sales and procurement.

Once governed weekly, the forecast becomes a living tool that sharpens with use – helping companies move from reactive firefighting to proactive cash management.

Even the best-designed 13-week forecast can fail if certain traps aren’t avoided. Most problems don’t come from the math — they come from process, ownership, or assumptions. Here are the most common pitfalls:

1. Double-counting cash flows

It’s easy to accidentally count the same invoice twice – once from the AR/AP ledger and once from forward-looking sales or purchasing forecasts. The result is overstated inflows or outflows.

Tip: Start with the ledgers as your baseline, then layer in only incremental forecasted items. Use clear flags in your spreadsheet to mark “ledger-based” vs. “forecast-based” entries.

2. Over-optimistic assumptions

Sales teams often assume customers pay on time; procurement may understate upcoming purchases. Reality is usually messier.

Tip: Calibrate assumptions to history. If your DSO runs at 47 days, don’t model collections at 30 – unless you have a concrete plan to change behavior.

3. Ignoring Capex timing

Capex is one of the most frequently missed items. Companies either exclude it entirely or spread it evenly across months, which doesn’t reflect reality.

Tip: Demand ownership of Capex cash timing from project managers. Even tentative projects should have a “best guess” date and amount.

4. Too much detail, too little insight

Modelling every customer and supplier individually creates noise and slows down the process. Forecasting becomes a chore instead of a decision tool.

Tip: Focus on the big drivers (top 10–20 accounts) and use weighted averages for the rest. Review variances weekly to decide which accounts deserve more granularity.

5. Lack of governance and accountability

A spreadsheet without a review forum is just a file. Without cross-functional ownership, the STCF quickly becomes outdated or ignored.

Tip: Treat the forecast as a living tool. Freeze a version weekly, review actual vs. forecast, and assign clear actions. The value comes from the conversations as much as the numbers.

6. No link to strategic decisions

Some companies build the forecast but never use it to guide real decisions. It becomes “reporting theatre.”

Tip: Tie STCF outputs directly to management actions — such as delaying discretionary Capex, phasing supplier payments, or accelerating collections. Otherwise, it’s just another spreadsheet.

Short-term cash flow forecasting is not just a finance exercise – it is a business discipline. Profits on paper don’t pay salaries, suppliers, or debt; only cash does. The STCF bridges that gap by providing visibility into the next 13 weeks, ensuring that potential liquidity risks are seen early and managed proactively.

When built and governed well, a short-term forecast does three things:

The formula for success is simple: start small, keep it practical, and improve with discipline. A spreadsheet with reliable inputs and weekly review already creates powerful visibility.

As the process matures, system tools can add automation and real-time dashboards – but they only deliver value if ownership, consistency, and collaboration are already in place.

The ultimate takeaway: Profit is reported quarterly, but cash is lived daily. Companies that master short-term cash flow forecasting don’t just avoid surprises – they gain the agility and confidence to invest, grow, and thrive in uncertain times.

It provides visibility into cash inflows and outflows over the next quarter. This horizon is long enough to spot risks and short enough to keep forecasts accurate.

The cash flow statement reports historical performance.

The STCF is forward-looking, focused on future liquidity management.

Ideally both: bottom-up for the near term (1–4 weeks) using invoices and payroll, and top-down for weeks 5–13 using assumptions and averages.

Finance should govern the process, but inputs must come from operations, sales, and procurement. Cash is generated across the business, not just in finance.

Weekly is best practice. Each update should include a variance review between forecast and actuals to improve accuracy.

Not at first. A spreadsheet is enough to start. Systems add value once the process, ownership, and data discipline are established.

Because it strikes the balance between detail and foresight. It helps identify cash shortfalls before quarter-end, when lenders and investors are most focused.

Typically: accounts receivable and payable, payroll, taxes, debt service, rent, leases, and Capex. Forward-looking estimates from sales and procurement are layered on top.

Accuracy matters most in the first few weeks, where decisions are immediate. Beyond 4–5 weeks, forecasts become assumption-driven, so the goal is directionally correct visibility rather than perfection.

Turn theory into practice and boost your career with accredited training. Become a Certified Working Capital Expert by enrolling in our flagship course: Managing Working Capital.

Check out all Working Capital Hub Insights here