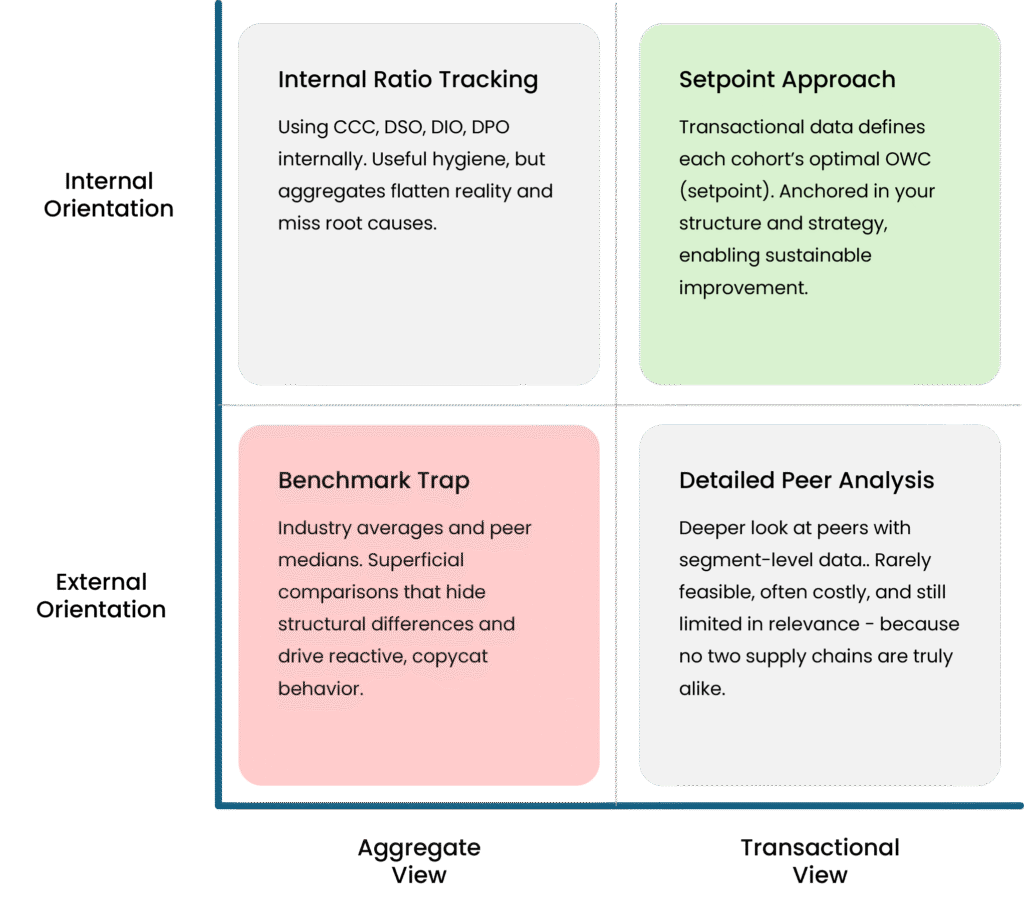

Benchmarking is one of the most widely used – and most misused – tools in corporate finance.

The appeal is obvious: simple ratios and peer comparisons seem to offer clarity. But in practice, they often create noise – and lead companies into common benchmarking mistakes that look good on paper but weaken the business in reality.

When it comes to Operating Working Capital (OWC), benchmarking may tell you whether you are “in the ballpark” – but it will never tell you where the goalposts are.

This Hub Point of View explores why benchmarking misleads, the mistakes companies fall into, and how a setpoint approach offers a smarter path forward.

For a full overview of benchmarking working capital, see our guide here:

Industry benchmarks are built on P&L and balance sheet aggregates. They flatten reality into medians and quartiles. But OWC isn’t generic – it is context-specific.

Two companies in the same sector can differ by months in their cash conversion cycles. Those gaps are not explained by efficiency alone. They reflect structural realities: market positioning, supplier terms, customer mix, and strategic choices.

Chasing averages can therefore be dangerous: stretching payables in ways that damage supplier trust, or cutting buffers that safeguard service and resilience. The result?

Performance theatre – ratios that look good on paper but leave the business fragile.

The smarter alternative is to define your setpoint – the optimal level of working capital for your company, given its supply chain, customer base, and strategy.

This requires moving away from league tables and into your own transactional data. Instead of asking: “How do we compare to peers?” ask: “How does this customer, SKU, or supplier perform against its setpoint – the level required to efficiently and effectively support operations?”

Internal benchmarking means:

Benchmarking often drives companies into traps that look good on paper but erode performance in reality. Some of the most common mistakes include:

With transactional visibility, AI, and real-time data, external benchmarking may become obsolete. Companies are already shifting from annual league tables to continuous, internal setpoints:

External benchmarks won’t vanish — but their role will be to provide context, not direction.

Shifting from benchmarks to setpoints isn’t about chasing new ratios – it’s about changing how the business thinks and acts. Three principles make the difference:

Data discipline – without clean, accurate transactional data, you’re steering blind.

Internal mastery – fix your own leaks before copying someone else’s playbook.

End-to-end alignment – finance, sales, procurement, and operations all need to aim at the same setpoint, or the system snaps back to old habits.

Get these right, and benchmarking stops being a comparison game – it becomes a catalyst for building resilience and unlocking cash where it really sits.

Benchmarking is seductive because it offers easy numbers and comforting comparisons. But your optimal OWC level cannot be borrowed from peers.

It must be discovered, defined, and defended within the reality of your own supply chain. The only benchmark that matters is the one you set for yourself.

This article has shown why benchmarking often misleads. For the broader context and methodology, explore our full guide to Benchmarking Working Capital.

Check out all Working Capital Hub Insights here!