A core element of Lean Operating Working Capital is understanding that sustainable improvement cannot be achieved through isolated, function-specific initiatives.

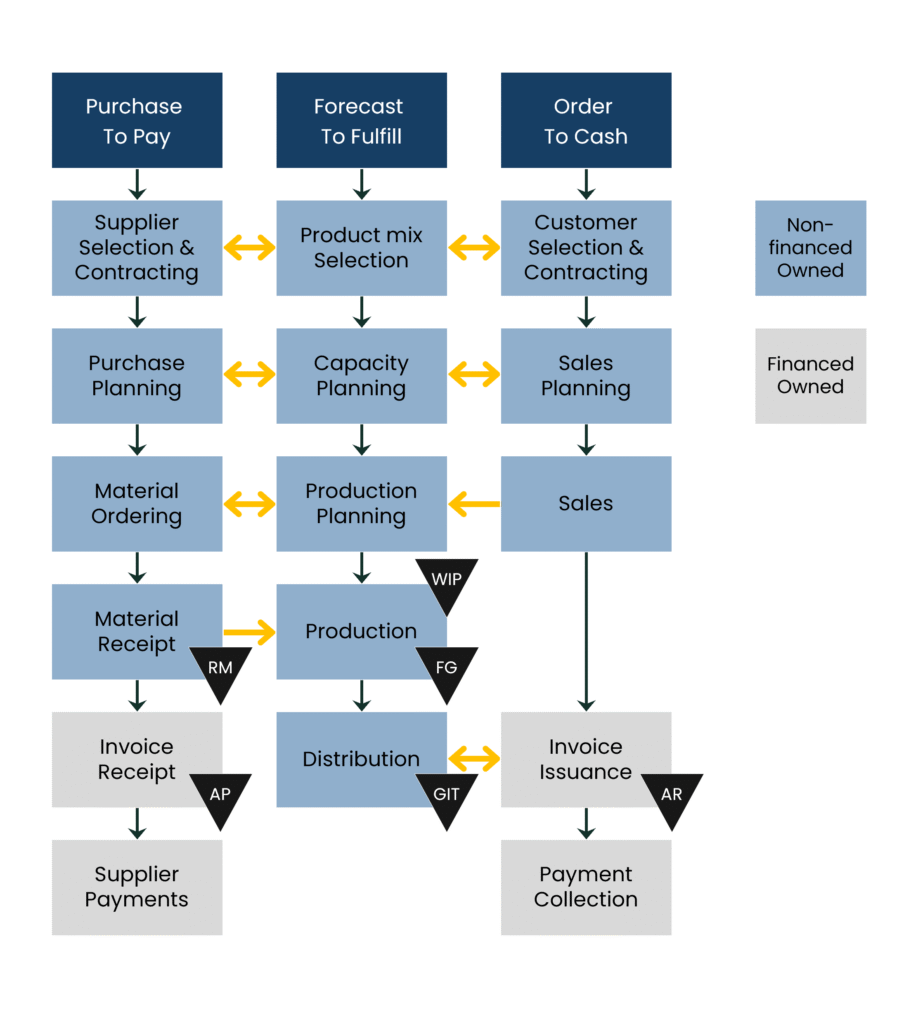

Setpoint thinking only becomes real when it is embedded across the company’s core value streams – Order to Cash (OTC), Forecast to Fulfil (FTF), and Procure to Pay (PTP).

Want to download this article for free?

Create a free account on My Academy Hub to download the article The Operating Working Capital Setpoint: Finding the Sweet Spot Between Cash, Growth, and Resilience today.

Working Capital has shifted from a financial housekeeping item to a frontline driver of competitive advantage.

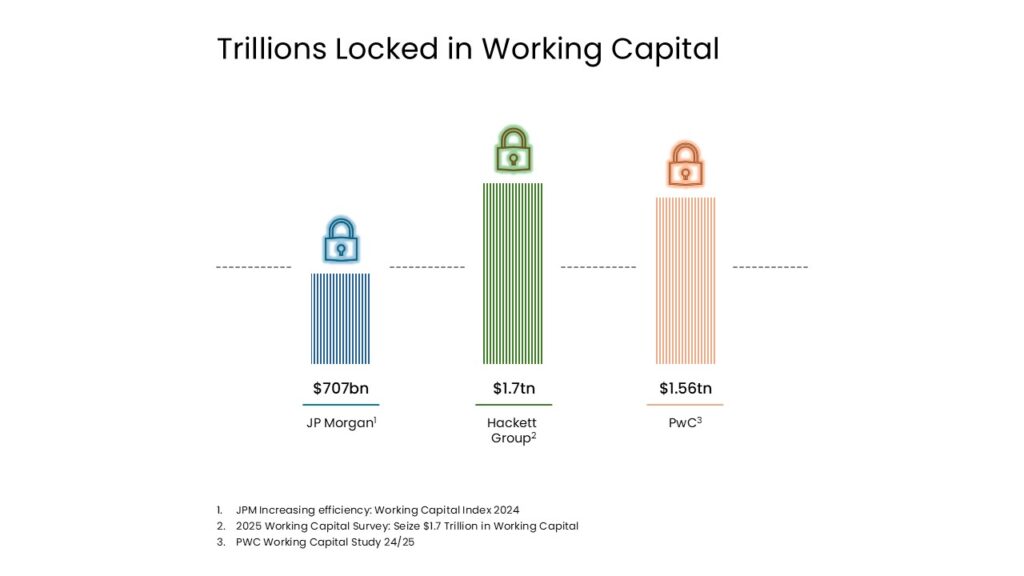

As revealed in J.P. Morgan’s Working Capital Index 2024, S&P 1500 companies are facing an alarming slowdown in working capital efficiency:

This is not a one-off. The Hackett Group’s 2025 survey shows U.S. corporates are leaving $1.7 trillion in liquidity untapped. Meanwhile, PwC’s 2024/25 study highlights €1.56 trillion in excess working capital locked across European balance sheets.

These numbers are staggering – but they are also an opportunity. Companies that treat working capital and liquidity as a strategic lever – not a by-product – will set the pace for tomorrow.

Become a Certified Working Capital Expert with our accredited course Managing Working Capital

The surface stability in working capital metrics hides a deeper truth:

The winners won’t be those who starve their supply chains, but those who:

In this context, AI is emerging as a game-changer – helping organizations surface real-time insights from their transactional data, from predicting late payments to fine-tuning demand forecasts.

Yet, systems and data can only take you so far. To truly capture the benefits, companies must also understand their core OWC requirements – their Setpoint. Without this calibration, even the smartest algorithms risk optimizing in the wrong direction.

The philosophy of Lean OWC draws on Lean Manufacturing: eliminate waste, make every resource work productively, and design systems that deliver maximum value with minimum friction.

It challenges five persistent operating working capital misconceptions:

At its core, Lean OWC is not about cutting harder. It is about finding balance – the right level of capital that sustains operations, protects resilience, and still releases cash for growth.

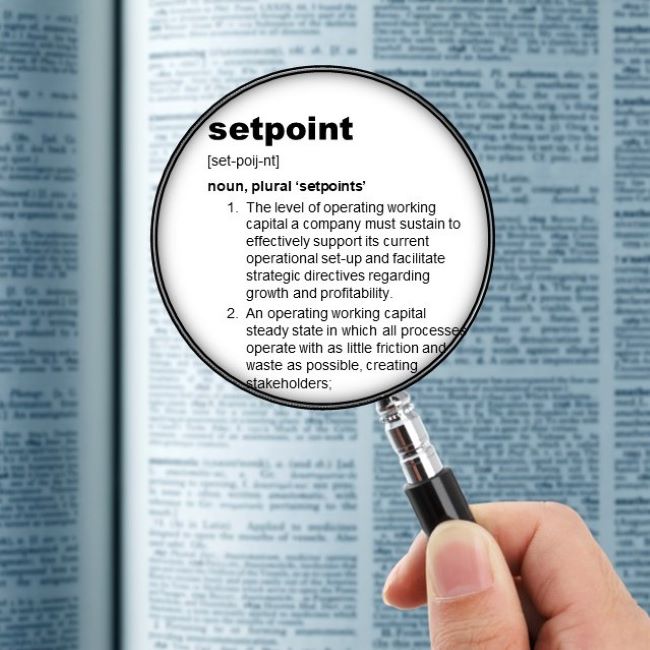

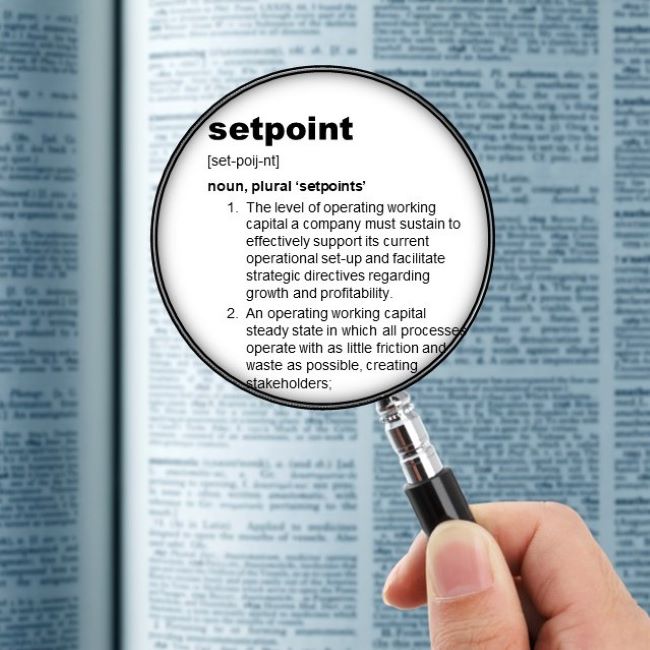

That right level is the Operating Working Capital Setpoint.

Think of the Operating Working Capital Setpoint as a company’s financial equilibrium. It’s the balance where efficiency and effectiveness meet:

The Setpoint is not about chasing extremes:

Many companies swing between “just in time” (running with the thinnest buffers possible) and “just in case” (stockpiling inventory and stretching receivables to feel safe).

Both extremes come at a cost:

The Operating Working Capital Setpoint is the smarter middle ground: “just enough, just right” – lean enough to free up cash, but robust enough to keep customers, suppliers, and operations running smoothly.

Your Operating Working Capital Setpoint isn’t a one-size-fits-all number. It reflects the structural conditions and inherent constraints of your supply chain, and how efficiently you operate within them.

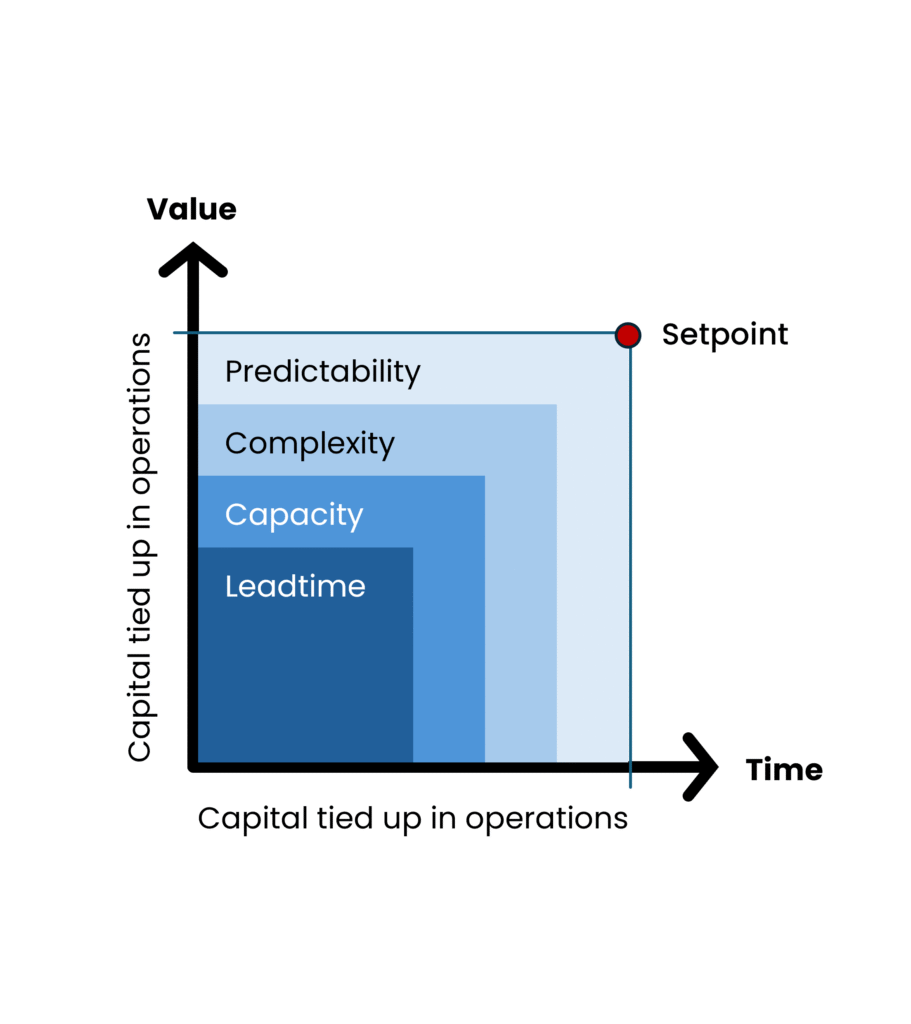

Four fundamental forces – Lead Time, Capacity, Complexity, and Predictability – determine how much operating working capital a business truly needs to run smoothly.

1. Lead Time – The Primary Driver of Working Capital

2. Capacity – The Limits of Throughput

3. Complexity – The Hidden Cost of Variety

4. Predictability – Confidence Reduces Capital

Together, these four forces determine how much operating working capital is structurally required to support operations at any given time.

Improving them does not just lower the Setpoint – it strengthens resilience, reduces waste, and creates a competitive advantage that finance alone cannot deliver.

The Setpoint is not just about the number – it’s also about the quality of what sits inside.

Consider a company with high levels of obsolete or slow-moving stock while constantly running short of fast-moving items. On paper, its OWC might look “in range.” In practice, the reality is painful:

To protect itself, the company adds more inventory “just in case,” which pushes OWC above its true Setpoint – locking in even more waste.

This is why Setpoint quality is critical. It’s not about how much you carry, but whether you carry the right things, in the right place, at the right time. Only then does working capital truly support growth, resilience, and profitability.

NorthAxis, a global industrial manufacturer, believed it was operating efficiently with 62 days of inventory. Finance launched a cash-release initiative, targeting a 10% reduction – expecting €40M to be freed.

Within weeks, service levels deteriorated. Expedite shipments surged.

Customers complained. Instead of unlocking liquidity, the company burned more cash protecting it. The problem wasn’t leadership discipline – it was a mis calibrated Setpoint.

A cross-functional review revealed four structural truths:

When NorthAxis recalculated its true Setpoint, it didn’t slash inventory – it rebalanced it.

Obsolete and low-velocity stock was cleared, buffers were redeployed to critical items, supplier terms were renegotiated, and capacity smoothing replaced panic planning.

The impact:

Lesson:

Operating working capital cannot be forced down through financial targets alone. The Setpoint only moves when the structural constraints that define it – Lead Time, Capacity, Complexity, Predictability – are addressed.

Operating Working Capital is more than a few lines on the balance sheet – it’s a diagnostic tool.

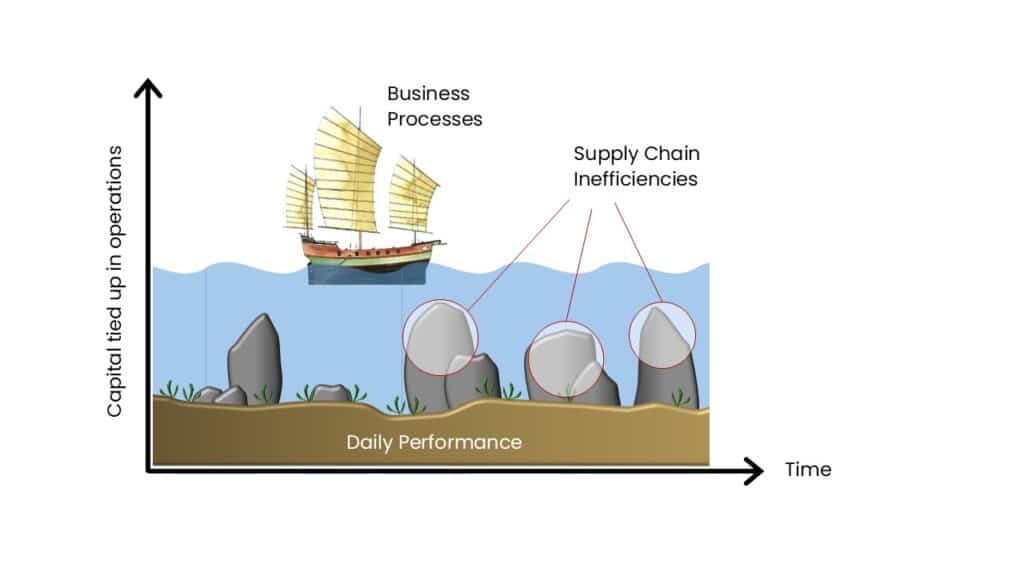

By understanding your optimal level of operating working capital – the Setpoint – companies can detect performance gaps early. Elevated OWC above the Setpoint often signals hidden inefficiencies, such as:

Inefficient processes inflate OWC. Inaccurate forecasts, last-minute production changes, and poor supplier performance all force companies to hold more buffers than they should.

Lean thinkers often explain this using the Japanese Sea analogy: water levels (inventory) hide the rocks (process problems). Lower the water without removing the rocks and ships get stranded.

OWC works the same way:

These buffers may provide temporary relief, but they mask root causes and create complacency.

By contrast, knowing your company’s Operating Working Capital Setpoint helps you separate symptoms from causes – and focus improvements where they matter most.

Without this calibration, OWC programs are like running in the dark: you may move quickly, but in the wrong direction – cutting too deep, or in the wrong places, creating new inefficiencies and ultimately rebuilding buffers at even higher levels than before.

Once you’ve identified where your company stands relative to its Operating Working Capital Setpoint, the next step is deciding how to move closer to it. Companies generally have two pathways:

Incremental improvements

Structural improvements

Both approaches matter. Incremental keeps you on track in the short term; structural reshapes what “good” looks like in the long term.

Analogy: Think of it like fitness:

The good news is that an Operating Working Capital Setpoint is not a matter of opinion or executive decree – it can be objectively calculated.

Unlike top-down targets pulled from the balance sheet, a true Setpoint is derived from transaction-level data that reflects how the business actually operates.

Each major component of OWC has its own Setpoint:

The Inventory Setpoint is calculated at the most granular level – by SKU – and is anchored in active planning parameters such as:

Because these factors vary across products, geographies, and supply chains, different business units or product lines will naturally operate with different inventory Setpoints. There is no single “right” number across the enterprise.

But the calculation is only the beginning. The Inventory Setpoint provides three critical insights:

Example:

The Inventory Setpoint therefore becomes a calibration tool: ensuring that working capital is not just minimized, but positioned correctly – the right products, in the right place, at the right time.

If inventory defines the buffers you hold, receivables determine how quickly cash flows back in.

The Receivables Setpoint is anchored in contractual customer payment terms and can be calculated objectively:

This analysis does more than set a baseline. It uncovers three critical insights:

Example:

The Receivables Setpoint therefore becomes a calibration tool: not just to set realistic liquidity expectations, but to align commercial policy, customer relationships, and growth strategy with financial discipline.

And payables complete the cycle – showing how long cash stays in the business before it flows out again.

The Payables Setpoint is defined by contractual supplier terms and actual payment practices. It can be calculated objectively as:

But the value of this calculation goes beyond establishing a baseline. It answers three key questions:

Example:

The Payables Setpoint, when properly understood, provides a calibration tool: ensuring that payables practices free up cash without compromising supplier trust – striking the right balance between liquidity, competitiveness, and long-term supply chain stability.

Each Operating Working Capital component has its own Setpoint, and different business units may operate with different baselines depending on their supply chain conditions. But taken together, they create the company’s overall Operating Working Capital Setpoint.

Just as no single supply chain process defines performance, no single component defines OWC. Only by calibrating inventory, receivables, and payables in unison can companies establish their true financial equilibrium – one that frees cash productively, sustains relationships, and strengthens resilience.

A core element of Lean Operating Working Capital is understanding that sustainable improvement cannot be achieved through isolated, function-specific initiatives.

Setpoint thinking only becomes real when it is embedded across the company’s core value streams – Order to Cash (OTC), Forecast to Fulfil (FTF), and Procure to Pay (PTP).

These end-to-end processes are where working capital actually lives:

If improvements are made in only one pillar – squeezing suppliers in PTP, reducing stock in FTF, accelerating collections in OTC – the result is predictable: disruption, resistance, and a short-lived Hawthorne effect.

It’s important to recognize that these frictions do more than inflate operating working capital – they quietly erode the entire operating model.

Local interventions taken without end-to-end alignment don’t just trap cash; they drive up process costs, create operational firefighting, and undermine growth potential.

Excess buffers mask inefficiencies, service disruptions weaken customer trust, and reactive decisions strain supplier relationships. In other words, when operating working capital is managed in isolation, companies don’t just lose liquidity – they sacrifice competitiveness.

By maintaining a cross-functional, process-led approach, companies build trust and secure true ownership of outcomes. Instead of focusing on symptoms (levels of DIO, DSO, DPO), teams align on root causes within transaction flows – terms, planning parameters, lead times, constraints.

This transforms Setpoint from a financial benchmark into a shared operational standard. Setpoint becomes the question every team must ask inside OTC, FTF, and PTP:

The Operating Working Capital Setpoint isn’t just a financial benchmark – it is a strategic lens for how a business truly operates. It forces leaders to look beyond balance sheet metrics and confront the structural realities that shape performance: lead times, capacity limits, product complexity, and planning predictability.

By anchoring operating working capital in the flow of core processes – OTC, FTF, and PTP – Setpoint thinking replaces one-time targets with a shared operational standard. It prevents the two great mistakes: starving the business in pursuit of cash, or masking inefficiency through excess.

In the end, the Setpoint helps leaders answer not just “What does good look like?” — but a far more powerful question:

Companies that embed this discipline don’t just optimize liquidity.

They build resilience, accelerate growth, and compete with precision.

The Setpoint is the optimal level of working capital where efficiency and effectiveness meet. It’s not the lowest possible level, nor the highest buffer-heavy position - but the “just enough, just right” point that balances resilience, liquidity, and growth.

Unlike top-down balance sheet targets, the Setpoint is derived from transaction-level data. Each component - inventory, receivables, and payables - has its own Setpoint based on contractual terms, planning parameters, and supply chain conditions. Together, they create the enterprise-level equilibrium.

No. A company’s Setpoint depends on its industry, supply chain structure, seasonality, growth rate, and operational efficiency. Even within a single company, different business units may have different Setpoints.

Traditional targets often push companies to cut too deep or carry too much. The Setpoint removes guesswork and bias, showing what good looks like for your specific context - and ensuring that improvements don’t undermine resilience or growth.

By treating it as both a diagnostic tool (to uncover inefficiencies) and a strategic guide (to align finance, operations, and supply chain). Leaders can use the Setpoint to set realistic targets, direct improvement programs, and turn working capital into a competitive advantage.

Turn theory into practice and boost your career with accredited training. Become a Certified Working Capital Expert by enrolling in our flagship course: Managing Working Capital.

Categories