This perspective on AI-Powered Credit Analysis draws on insights from the author’s work in AI-powered credit automation at FinProdAI.

I’m a strong advocate for automation – specifically, automation that frees up time for people to focus on the parts of their job that truly matter. Too often, we waste hours on repetitive, low-value tasks like copy-pasting data from one source to another.

And trust me, there is far more copy-pasting going on in the financial industry than you might imagine. Filling out massive forms, duplicating information – it’s a drain on both productivity and engagement.

Take underwriting, for example. The value of the job lies in the challenge of analysis and decision-making: should we say yes or no, and on what terms?

That process requires a fully engaged, analytical mindset. If your analyst brain isn’t switched on, you’re more likely to miss a good opportunity – or worse, approve a poor one. This is why Gen AI is so powerful.

If it can eliminate those unnecessary, repetitive steps and give underwriters and credit-analysts more time to focus on actual decision-making, it will lead to better outcomes.

Not only will decisions improve, but staff will be more fulfilled. The goal isn’t to replace underwriters or credit-analysts – it’s to let them focus on the parts of their jobs they enjoy and that truly matter.

Credit analysis is still dominated by manual, repetitive work, creating backlogs, delays, and inconsistent decisions.

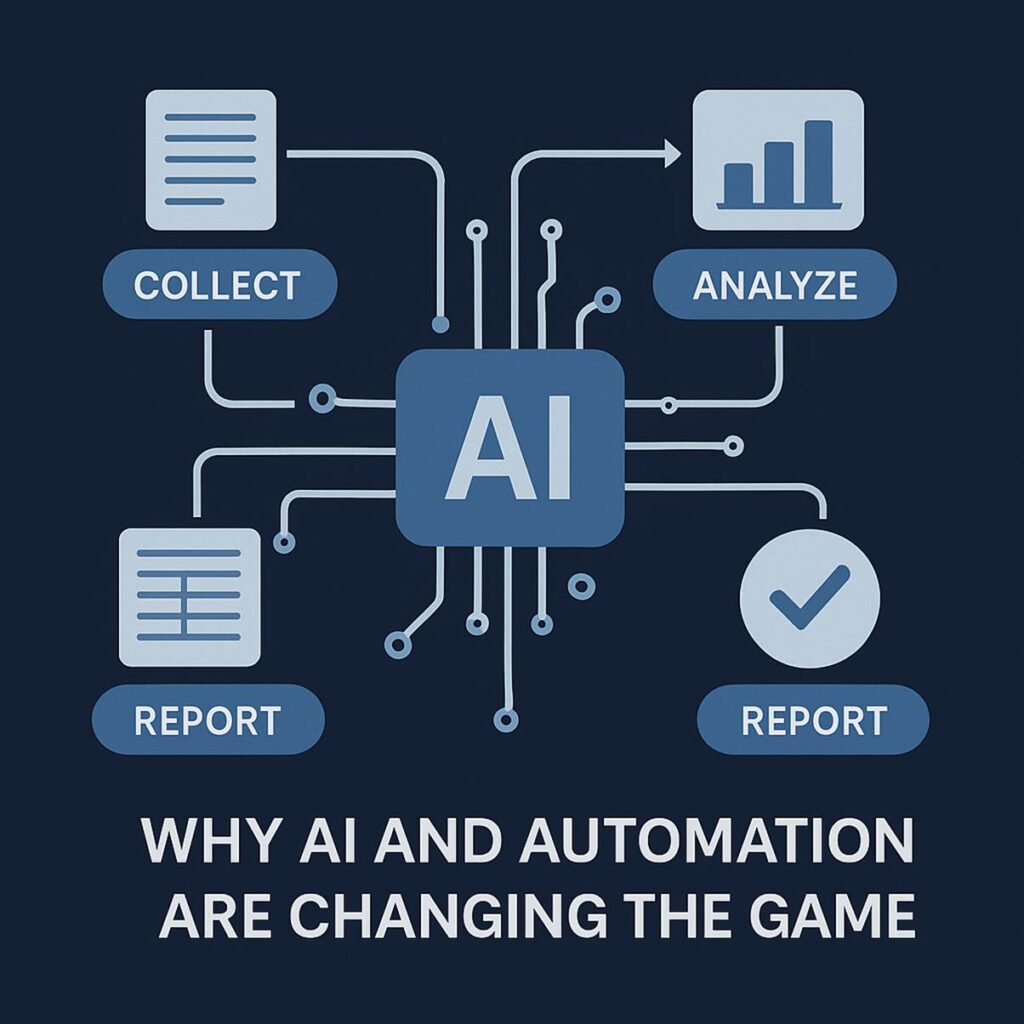

Generative AI can automate high-effort, low-judgment tasks such as data extraction, memo drafting, and document processing — without replacing analysts.

The goal is not automation for efficiency alone, but freeing analysts to focus on judgement, negotiation, and risk decisions where human expertise adds real value.

AI adoption in credit is accelerating, with leading institutions already using it to improve underwriting speed, decision quality, and working capital performance.

AI-powered credit tools must be domain-specific, explainable, and compliant, blending automation with full human oversight.

Acting now creates strategic advantage, as lenders who modernize their credit workflows will move faster, scale smarter, and strengthen their working capital performance and cash conversion cycle.

Each of those steps often involves manual data extraction, time-consuming back-and-forth clarifications, and repeated rework. A “simple case” might take 15 minutes of pure analyst time; a complex group with multiple entities can take days or even weeks. Over a month, dozens of such files accumulate, delays mount and backlogs increase.

The outcomes of this manual burden include:

In short: being busy is not the same as being productive.

Evidence from the workplace: A recent article in Unionen’s Kollega (Issue 6/2025, Swedish) reports on a study showing that employees lose more than a month of productive time each year due to slow, cumbersome, and outdated IT systems.

When digital tools don’t work, staff often resort to “shadow IT”: downloading unauthorized apps, using private devices, or creating ad-hoc workarounds just to get their jobs done. The result is not only lost productivity but also higher security risks.

According to McKinsey’s 2025 State of AI report, 78 % of respondents say their organizations use AI in at least one business function, up from around 72 % in early 2024 and about 55 % a year earlier.

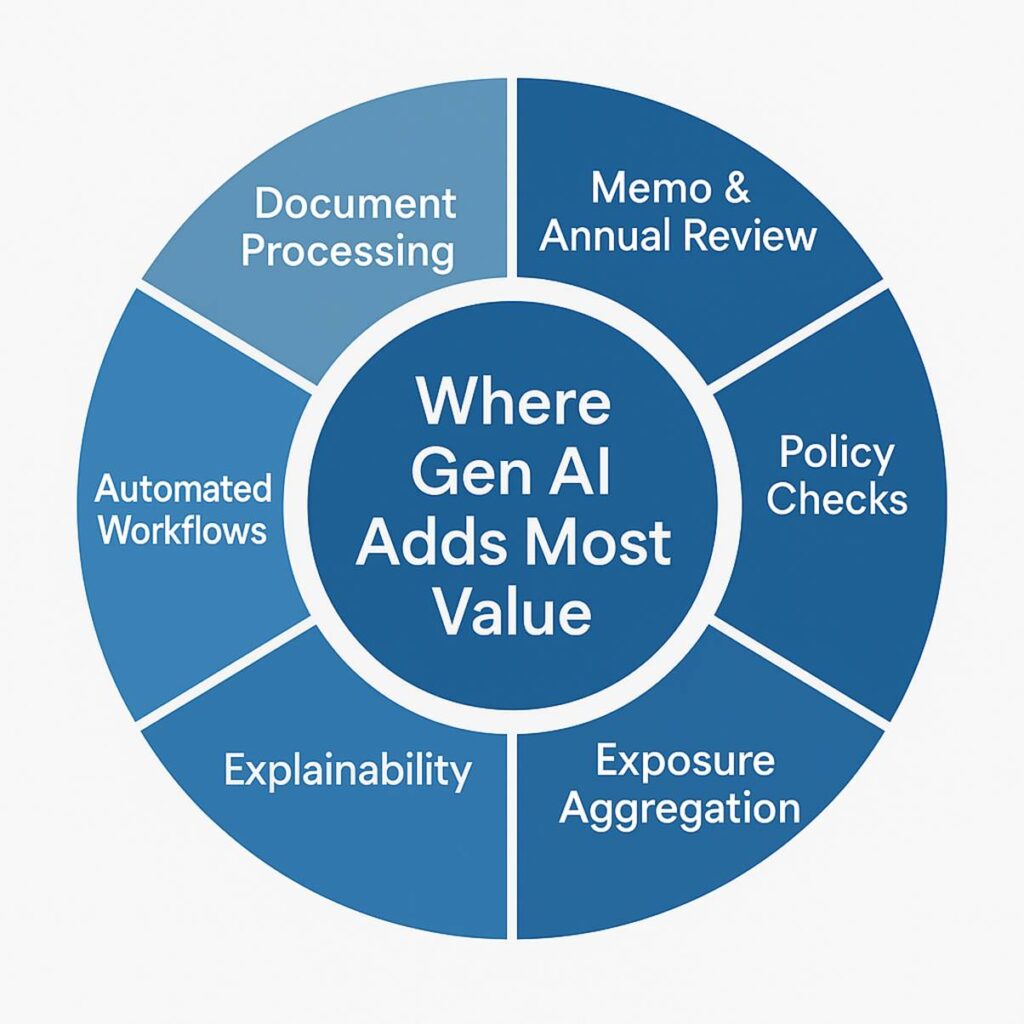

In credit, McKinsey’s Embracing Generative AI in Credit Risk outlines how financial institutions are applying generative AI across underwriting workflows—document review, information synthesis, policy checks, and drafting memo segments among them.

Moreover, the IACPM – McKinsey Emerging Generative AI Use Cases in Credit report provides concrete case examples of use cases like memo drafting, exposure aggregation, document processing, and policy flagging under exploration across credit portfolios

What changed is generative AI and large language models (LLMs). Unlike older analytics systems, generative AI can:

In credit, AI is now being applied to read documents, flag potential policy deviations or missing data, and draft sections of credit memos for further review.

Note on “continuous learning”: In regulated settings, enterprise AI typically does not self-learn in production. Improvements come via governed updates (prompt refinements, supervised fine-tuning, retraining) under model risk management – so performance can improve without uncontrolled drift.

I am a strong advocate for automation – specifically, automation that frees up time for people to focus on the parts of their job that truly matter. Too often, we waste hours on repetitive, low-value tasks like copy-pasting data from one source to another. And trust me, there is far more copy-pasting going on in the financial industry than you might imagine. Filling out massive forms, duplicating information- it’s a drain on both productivity and engagement.

Take underwriting, for example. The value of the job lies in the challenge of analysis and decision-making: should we say yes or no, and on what terms?

That process requires a fully engaged, analytical mindset. If your analyst brain isn’t switched on, you’re more likely to miss a good opportunity – or worse, approve a poor one.

This is why Gen AI is so powerful. If it can eliminate those unnecessary, repetitive steps and give underwriters and credit-analysts more time to focus on actual decision-making, it will lead to better outcomes.

Not only will decisions improve, but staff will be more fulfilled. The goal isn’t to replace underwriters or credit-analysts – it’s to let them focus on the parts of their jobs they enjoy and that truly matter.

But the final call? That stays with the human.

Excessive automation risks creating ‘herding behaviour,’ where there is a danger in too much automation.

It can cause us to overlook opportunities. Imagine a customer segment with a 20% default risk – automated models may say no across the board.

But what about the 80% that don’t default? If we’re not careful, we may all end up saying no to the same people for the same reasons, eliminating differentiation.

The sweet spot is automating supporting work – data ingestion, drafting, compliance checks – while reserving final decisions and negotiations to skilled humans.

Not every step in credit analysis demands automation. The greatest returns lie in areas that are high volume, repetitive, but rich in data. Below are key domains where AI shines:

It’s important to prioritize: focus on building capabilities that address frequent and challenging problems and can be reused across multiple scenarios. That’s how ROI compounds.

Beyond process efficiency, AI-driven credit analysis also strengthens a company’s financial health by directly impacting its working capital position.

Want to learn more about the Order to Cash cycle and Receivables?

Check out Accounts Receivable: Complete Guide, Metrics & Best Practices.

Effective credit analysis does more than manage risk, it directly shapes a company’s working capital performance. Every decision on customer credit limits, payment terms, or portfolio exposure affects cashflow, the order-to-cash cycle, and ultimately the company’s ability to fund growth.

When credit teams use AI-powered tools to assess counterparties faster and more accurately, they not only protect against bad debt but also unlock cash tied up in receivables. Here’s how credit analysis directly supports working capital efficiency:

AI-enhanced credit analysis allows companies to approve new customers and extend credit limits more quickly, reducing sales friction. This accelerates the order-to-cash cycle, helping businesses convert sales into cash faster and improving cashflow forecasting accuracy.

This happens when teams exaggerate forecasts to safeguard resources or quotas.

Aggregating data across customers and sectors helps finance leaders spot concentration risks and reallocate exposure dynamically. AI-driven credit tools enable predictive scenario analysis, linking credit quality trends to working capital efficiency and profitability.

By removing repetitive work – such as extracting data, comparing financials, or preparing credit memos – AI lets analysts and treasury teams collaborate more closely. The result: a connected view of credit risk and cashflow health, essential for sustainable working capital management.

In short, credit analysis is not just about preventing losses – it’s a lever for releasing cash. When done intelligently and supported by AI, it becomes a strategic function that balances growth, risk, and liquidity.

Not all AI or automation tools are equal. For a credit analysis software to succeed in a regulated financial environment, several qualities are essential:

A tool that balances automation with control (quality, traceability, editability, human in the loop) is far more likely to gain adoption in credit organizations.

Why Now Is the Strategic Moment – Several converging trends make 2025 particularly compelling:

To see how FinProdAI’s Gen-AI assistant is built specifically for credit analysis and how it handles these challenges, visit finprod.ai or contact us at contact@finprod.ai

Want to see how these AI capabilities work in practice?

Explore how FinProdAI is applying generative AI to credit analysis, memo automation, and working capital improvement – built specifically for B2B businesses.

Credit analysis is at a crossroads. The traditional, labor-intensive approach cannot sustainably scale as B2B commerce grows and the demand for faster decisions intensifies.

AI-powered credit analysis software offers a bridge: it automates the tedious, supports analysts, and enhances consistency, without relinquishing human judgment.

But adoption is not automatic.

The future isn’t about choosing between humans or machines – it’s about orchestrating a smart collaboration where people do what they do best, and machines support them.

If done well, B2B credit will not just evolve – it will accelerate.

Credit analysis assesses a company’s financial stability and repayment ability. In B2B lending, it guides decisions on credit limits, payment terms, and risk exposure, directly influencing working capital, liquidity, and growth.

It depends heavily on manual data collection, spreadsheet work, and memo writing. Each case can take hours or even days, causing backlogs and slowing down decisions across the organization.

AI automates repetitive steps such as data extraction, normalization, memo drafting, and policy checks. This allows analysts to focus on higher-value work like interpretation and decision-making, while improving accuracy and speed.

Generative AI can read, summarize, and interpret financial data from PDFs, reports, and emails. It helps analysts by creating draft memos, identifying risk patterns, and finding missing information, while keeping humans in full control.

By enabling faster and more consistent credit decisions, AI helps shorten the cash conversion cycle, improve collections, and optimize capital allocation. This strengthens liquidity and overall cash flow management.

No. The goal is to support analysts, not replace them. AI handles routine work, giving analysts more time for strategic tasks such as risk assessment, client discussions, and portfolio management.

The best tools are specialized for finance, transparent, and secure. They provide clear explanations for results, integrate with credit and KYC systems, scale easily, and always allow human review before decisions are finalized.

Explainable AI shows which factors influenced an outcome and links them to their source. For example, “Flagged due to rising leverage ratio in the 2024 annual report, page 14.” This transparency supports compliance and auditability.

AI adoption has reached maturity across industries. Proven frameworks for explainability and governance now make large-scale deployment safe and cost-effective. Organizations that act now gain a lasting competitive advantage.

FinProdAI is purpose-built for banking and B2B credit. It uses financial language models, visual document traceability, and secure EU-based hosting to deliver accurate, explainable, and compliant analysis in seconds.

Turn theory into practice and boost your career with accredited training. Become a Certified Working Capital Expert by enrolling in our flagship course: Managing Working Capital.

Categories