Want to download this article for free?

Create a free account on My Academy Hub to download the article What is Operating Working Capital | Definition, Formula and Business Application today.

Operating Working Capital (OWC) is a critical measure of business efficiency, cash flow, and profitability.

While working capital shows a company’s short-term liquidity, OWC focuses only on the operational drivers – inventory, receivables, and payables – that determine how effectively cash is generated and used in day-to-day activities.

Understanding and optimizing OWC helps businesses improve their cash conversion cycles, free up liquidity, improve financial performance, and sustain growth.

This article explains what OWC is, how it differs from working capital, and why mastering it is essential for long-term profitability and resilience.

Definition → Operating Current Assets – Operating Current Liabilities

Formula → Operating Working Capital (OWC) = Inventory + Accounts Receivable + Supplier Prepayments – Accounts Payable – Customer Prepayments.

Purpose → Measures efficiency & effectiveness of capital tied up in operations.

Target → Every company requires a baseline OWC to run smoothly, their OWC Setpoint.

Too Much OWC → Inefficiency, idle cash, hidden process waste.

Too Little OWC → Firefighting, stockouts, missed opportunities.

Focus Areas → Inventories, receivables, and payables each require distinct attention.

Application → Successful companies don’t aim for the lowest OWC – they aim for the right OWC, tuned to their business model.

Become a Certified Operating Working Capital Expert with our accredited course Managing Working Capital

Two terms that often get confused are working capital and operating working capital. While they sound similar, they measure different things and serve different purposes in financial reporting and management.

| Working Capital (WC) | Operating Working Capital (OWC) | |

|---|---|---|

| Definition | Current Assets – Current Liabilities | Operating Current Assets - Operating Current Liabilites |

| Components | All current assets: cash, short-term investments, receivables, inventory, prepayments. All current liabilities: accounts payable, accrued expenses, taxes payable, short-term financial debt | Only operating current assets: inventory, receivables, supplier prepayments. Only operating current liabilities: accounts payable, customer prepayments |

| Purpose | Measures liquidity: can the company meet short-term obligations? | Measures efficiency: how much cash is tied up in daily operations? |

| Exclusions | None - it’s a broad balance sheet measure | Excludes financial assets (cash, short-term investments) and financial liabilities (short-term debt, accrued interest, tax payables, payroll liabilities) |

| Key Question Answered | “Do we have enough liquidity to survive in the short term?” | “How effectively is capital being deployed in operations?” |

| Use Case | Liquidity analysis, creditworthiness, short-term risk assessment | Operational efficiency, cash conversion cycle analysis, working capital optimization |

| Management Focus | Ensuring liabilities can be paid when due | Reducing excess tied-up capital without harming service or growth |

As mentioned before, the Operating Working Capital metric includes only a company’s operating assets and operating liabilities. It thereby excludes items outside the company’s immediate operational control.

Financial items, such as payroll taxes, unpaid taxes, and payments on debt, are therefore excluded. Cash is also excluded as it is not directly affecting operations but is rather a consequence of how well the company performs.

Operating Working Capital = Operating Current Assets – Operating Current Liabilities

Or:

Operating Working Capital = Inventory + Accounts Receivable + Supplier Prepayments – Accounts Payable – Customer Prepayments

Operating working capital optimization is not about wildly cutting inventories or running the business on a shoestring. It is about understanding the circumstances of a business, making sure you are not under- or over-serving customers, tailoring operations to strike a balance between service and cost.

The winner is not necessarily the one with the least operating working capital, but the one with the right operating working capital.

All companies require a certain level of operating working capital to effectively support its operations and a healthy cash flow. The trick is understanding how much this is to avoid creating inefficiencies along the way.

The challenge is of course, to read and act on these symptoms, a company must first understand and its baseline operating working capital requirements. Working Capital Hub calls this equilibrium a company’s operating working capital Setpoint.

A company whose short-term operating assets are greater than its short-term operating liabilities (a positive OWC) will require short-term funding, to finance the cash tied up in operations.

Conversely, a company whose short-term operating liabilities are greater than its short-term operating assets (a negative OWC) does not require any additional funding. This is because it is effectively funded by its suppliers or through customer pre-payments.

Although a negative operating working capital is a useful source of free funding for companies, it is not appropriate nor achievable for all businesses. It can predominantly be found in industries with high inventory turnover and where customer payments are received immediately against sales.

Grocery stores and retailers can be found in this category. It is also prevalent in industries where customer pre-payments are common, such as construction projects.

However, operating with negative operating capital is not without risk.

Companies who rely on negative operating capital to finance its operations are sensitive to changes in demand. A sudden or unexpected drop in sales or inflow of customer pre-payments would create a funding gap the company must resolve.

Companies with negative operating capital should therefore always track its short-term cash flow diligently, to identify risks and allow for proactive counter measures if the situation changes.

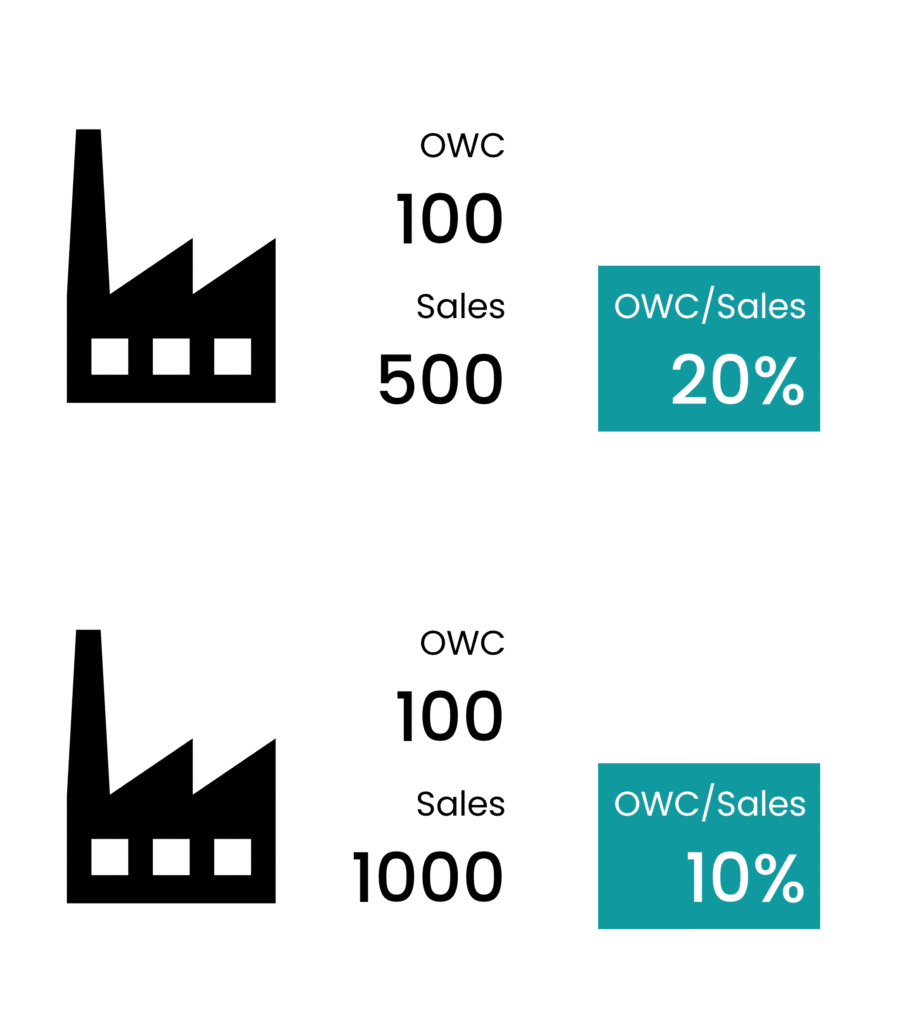

Looking at operating working capital as an absolute value makes little sense. Consider two companies with the same net operating working capital of 100. Are they performing well? It is hard to draw any conclusions based on this information alone.

However, if we were told that one company uses its operating working capital to generate sales of 500, whilst the other manages to generate sales of 1000, it is easier to have an opinion.

Operating working capital divided by sales is therefore a common metric, showing how effectively a company can convert its invested operating working capital into sales.

OWC% = OWC / Last 12 months Sales

This relative measurement is effective when following progress over time, visualizing a company’s aggregated operating working capital performance and its trend. The higher the sales a company can generate from its operating working capital, the more efficient it is.

It can also be used to benchmark against relevant peers. However, as always, benchmarks should be approached with caution, as it can be difficult finding relevant companies to compare.

Successful management of operating working capital also means measuring the individual performance of inventories, accounts payable and accounts receivable. An efficient working capital practice therefore uses additional key performance ratios, such as return on working capital, inventory ratios, collection ratios, and payment ratios, to help identify areas that require focus to maintain liquidity and profitability.

Improving Operating Working Capital is about much more than tightening budgets – it’s about making smarter use of the assets and liabilities tied to daily operations.

By managing receivables, payables, and inventory more effectively, companies can free up cash, strengthen liquidity, and support growth without relying on external financing.

Below are 10 practical strategies to help optimize OWC and boost overall business performance.

By implementing the above strategies, a company will improve its working capital and strengthen its financial position, ultimately enhancing its ability to meet short-term obligations and support long-term growth.

Operating Working Capital (OWC) is far more than a financial metric – it is a window into how effectively a company manages its operations, cash flow, and growth capacity.

By focusing on the core elements of receivables, payables, and inventory, OWC reveals whether capital is being used productively to support business efficiency or unnecessarily tied up in operations.

Companies that understand their OWC setpoint, track performance against sales, and optimize processes across the supply chain can unlock liquidity, strengthen profitability, and build resilience.

In today’s competitive environment, mastering OWC is not just about improving balance sheet health – it is about ensuring long-term financial sustainability and strategic agility.

Turn theory into practice and boost your career with accredited training. Become a Certified Operating Working Capital Expert by enrolling in our flagship course: Managing Working Capital.

Categories