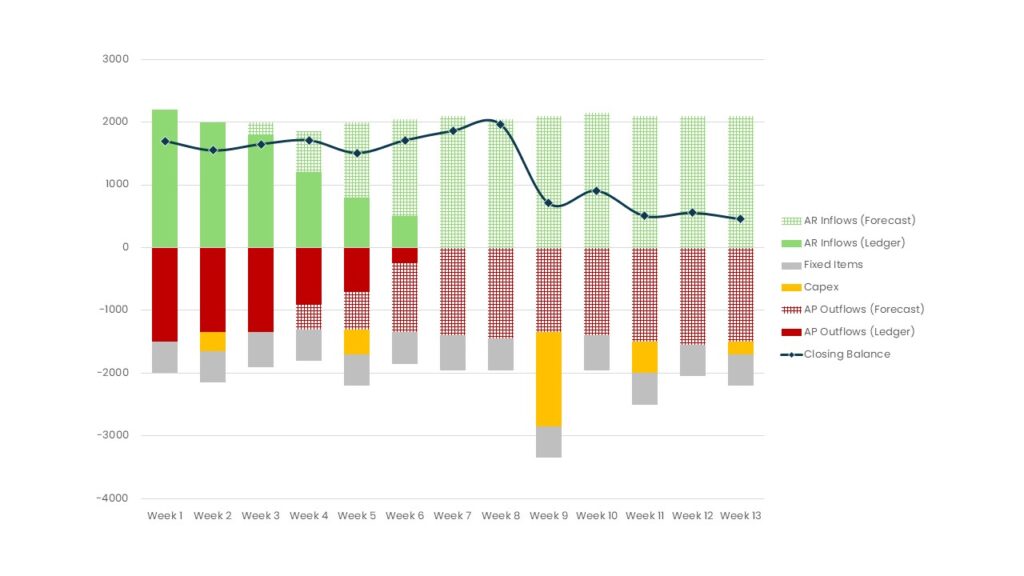

Short-term cash flow forecasts are designed to create clarity. Yet in many companies, they do the opposite. Instead of becoming a tool for confident decision-making, the forecast turns into a spreadsheet exercise riddled with errors, blind spots, and wishful thinking.

Why? Because even well-intentioned finance teams fall into a handful of common traps. From double-counting invoices to overlooking Capex outflows, these pitfalls undermine accuracy and erode trust in the process.

In this article, we highlight some of the most common 13-week cash flow forecast pitfalls. It will take you through the six most frequent mistakes in short-term cash flow forecasting – and explain how to avoid them. By tackling these issues, companies can turn the forecast into what it was meant to be: a practical, living tool that strengthens liquidity management and resilience.

For a full overview of how to set up a Short Term Cashfllow Forecast, see our guide here:

Even the best-designed 13-week forecast can fail if certain traps aren’t avoided. Most problems don’t come from the math — they come from process, ownership, or assumptions. Here are the most common pitfalls:

It’s easy to accidentally count the same invoice twice — once from the AR/AP ledger and once from forward-looking sales or purchasing forecasts. The result is overstated inflows or outflows.

Tip: Start with the ledgers as your baseline, then layer in only incremental forecasted items. Use clear flags in your spreadsheet to mark “ledger-based” vs. “forecast-based” entries.

Sales teams often assume customers pay on time; procurement may understate upcoming purchases. Reality is usually messier.

Tip: Calibrate assumptions to history. If your DSO runs at 47 days, don’t model collections at 30 — unless you have a concrete plan to change behaviour.

Capex is one of the most frequently missed items. Companies either exclude it entirely or spread it evenly across months, which doesn’t reflect reality.

Tip: Demand ownership of Capex cash timing from project managers. Even tentative projects should have a “best guess” date and amount.

Modelling every customer and supplier individually creates noise and slows down the process. Forecasting becomes a chore instead of a decision tool.

Tip: Focus on the big drivers (top 10–20 accounts) and use weighted averages for the rest. Review variances weekly to decide which accounts deserve more granularity.

A spreadsheet without a review forum is just a file. Without cross-functional ownership, the STCF quickly becomes outdated or ignored.

Tip: Treat the forecast as a living tool. Freeze a version weekly, review actual vs. forecast, and assign clear actions. The value comes from the conversations as much as the numbers.

Some companies build the forecast but never use it to guide real decisions. It becomes “reporting theatre.”

Tip: Tie STCF outputs directly to management actions – such as delaying discretionary Capex, phasing supplier payments, or accelerating collections. Otherwise, it’s just another spreadsheet.

Short-term cash flow forecasting doesn’t fail because the concept is flawed. It fails when discipline, realism, and ownership are missing. Avoiding the pitfalls of double-counting, optimism bias, Capex blind spots, excessive detail, weak governance, and “reporting theatre” makes the difference between a forecast that gathers dust and one that drives real decisions.

If you want to go beyond troubleshooting and learn the steps how to build a short-term cash flow forecast, check out our pillar guide:

Short-Term Cashflow Forecast (STCF): Definition, 13-Week Model, and Best Practices

Check out all Working Capital Hub Insights here!