If Working Capital Won’t Improve, You’re Battling Bias – Not Constraints

Many companies don’t struggle with operating working capital because of poor forecasts or long lead times. They struggle because of Supply Chain Bias – the hidden force of assumptions, incentives, and habits that inflate buffers and trap cash. If working capital never seems to improve, it’s not a constraint problem. It’s a bias problem. Here’s how to finally see it — and fix it.

The “Last 8%” of Supply Chains: Where Bias and Avoidance Undermine Performance

The “last 8%” problem, as described by JP Pawliw, refers to the critical conversations and decisions teams routinely avoid – stopping just short of addressing the hardest truths. This dynamic is not confined to leadership or team performance; it’s deeply embedded in supply chains. Sales, procurement, operations, and finance each make decisions that appear rational in isolation, yet collectively erode liquidity, resilience, and working capital efficiency. This is supply chain bias: the systemic avoidance of cross-functional trade-offs. Whether rooted in a “family” culture that avoids conflict, a transactional culture that prioritizes silos, or a fear-based culture where silence prevails, organizations leave performance on the table. Closing this last 8% requires courage, connection, and the willingness to confront the uncomfortable truths shaping inventory, receivables, and payables. Until then, the most damaging risks aren’t in disruption – they’re in the decisions we avoid.

The Hidden Enemy of Working Capital: How Supply Chain Bias Drains Cash and Agility

Supply chain bias is the hidden force that makes working capital improvements stall. When functions optimize for themselves, the business as a whole loses. This article explores how bias creeps into everyday decisions, why it is often mistaken for real constraints, and what leaders can do to break free—unlocking cash, agility, and trust across the supply chain.

Accounts Receivable: Complete Guide, Metrics & Best Practices

Accounts Receivable is more than “waiting to be paid.” It is a strategic balance between supporting customer growth and protecting your own liquidity. This guide explains AR fundamentals, credit risk, O2C processes, collections, metrics, financing tools, and future trends – showing how disciplined AR management turns reported revenue into real cash.

Accounts Payable: Complete Guide, Metrics & Best Practices

Accounts Payable is more than paying bills — it’s a financing tool, a supplier relationship lever, and a driver of working capital efficiency. This guide explores AP fundamentals, processes, metrics, strategy, regulation, and future trends.

5 Working Capital Misconceptions That Could Be Costing You Growth

Too many companies still believe myths and working capital misconceptions like “less working capital is always better” or “it’s finance’s problem.” Here’s why these misconceptions are costly – and how finding your OWC Setpoint unlocks growth and resilience.

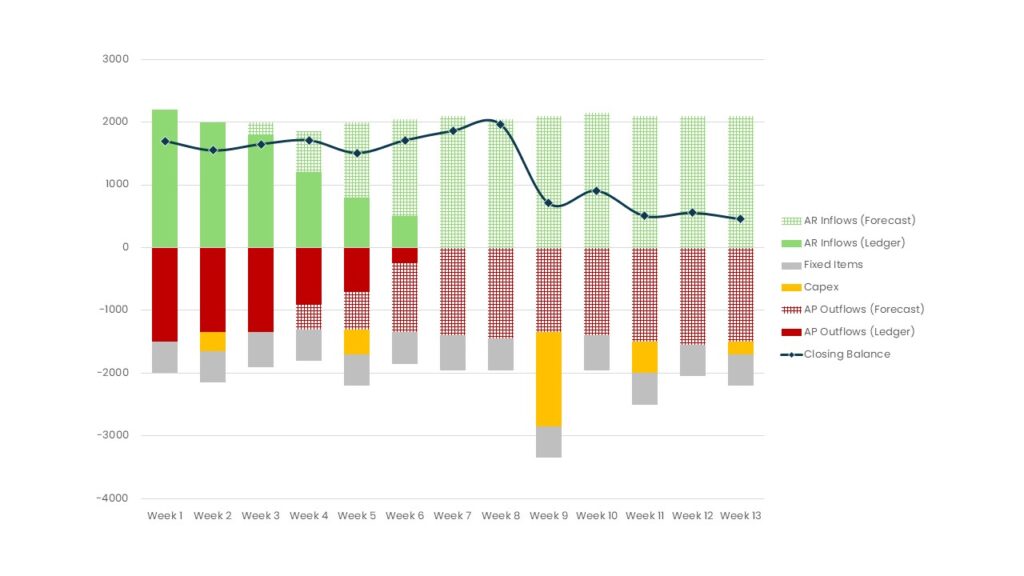

Short-Term Cash Flow Forecast (STCF): Definition, 13-Week Model, and Best Practices

Cash is lived daily, not just reported quarterly. A short-term cash flow forecast (STCF) gives companies the visibility to anticipate risks, make smarter decisions, and protect resilience. This in-depth guide explains why the 13-week horizon is the sweet spot, how to balance bottom-up detail with top-down efficiency, and the steps to create a forecast that works in practice. A must-read for finance and operations leaders seeking control over liquidity.

13-Week Cash Flow Forecast Pitfalls (and How to Avoid Them)

Avoid common 13-week cash flow forecast pitfalls. See the six mistakes – from double-counting to optimism bias – and how to fix them. Cash flow forecasts are meant to create clarity – but too often they do the opposite. Errors, blind spots, and over-optimistic assumptions can quickly undermine trust in the process. This article explores the six most common pitfalls in short-term cash flow forecasting and offers practical ways to avoid them. A must-read for finance leaders aiming to turn forecasts into reliable tools for liquidity management and decision-making.

Common Mistakes in Benchmarking Working Capital – and What to Do Instead

Benchmarking working capital can easily backfire. Industry averages flatten reality, and common mistakes in benchmarking working capital – like stretching payables too far or cutting buffers blindly – leave companies fragile. The smarter alternative is to define your own setpoint, based on data and strategy.

The Operating Working Capital Setpoint: Finding the Sweet Spot Between Cash, Growth, and Resilience

Working capital is no longer financial housekeeping — it’s a battleground for growth and resilience. At the center lies the Operating Working Capital Setpoint: the sweet spot where efficiency and effectiveness meet. This article explains why it matters, how it’s shaped by supply chain realities, and how leaders can calculate it objectively to free trapped cash and build lasting advantage.